保险是一个理解起来非常复杂的主题。如果您对它有不错的了解,那么任何保险公司推销的产品或服务您都能有一个接受或者拒绝的判断。从这点来看,投保时知道如何咨询保险公司也是很重要的一部分。无论您想购买人寿保险,还是汽车保险,这里有您在马来西亚投保需要了解的全部信息。

-

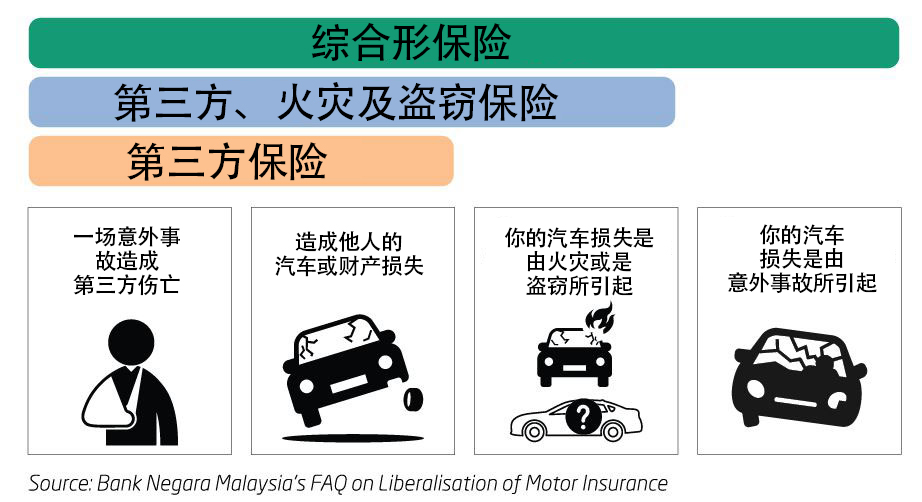

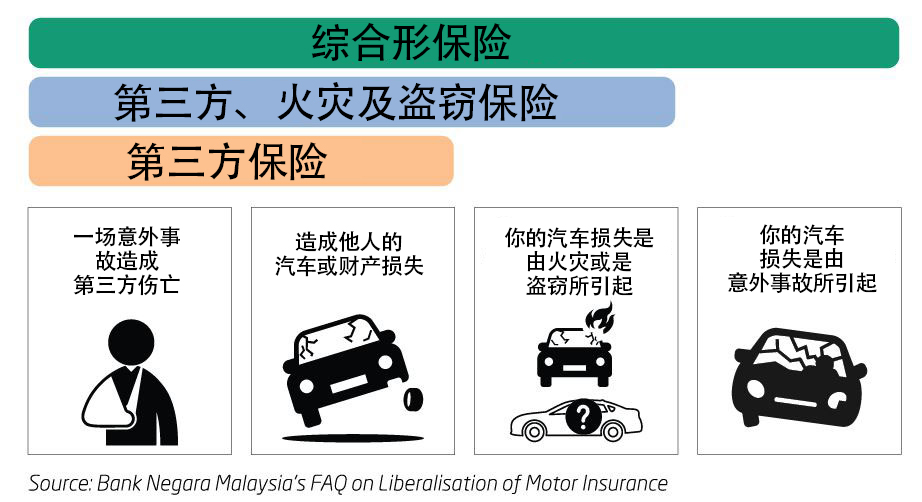

什么是综合型汽车保险?

这份保单是为了保障你在一场交通意外事故后,所造成自身汽车或第三方的损失。该保单覆盖范围包括人身伤亡和其他方的财产损失。

-

如何计算汽车保险费?

保险费是基于风险特征。潜在风险越高,保险费越高。潜在风险越低,保险费越低

-

什么是汽车保险自由化?

这意味着汽车保险费并不会再以汽车税作为考量(拥有固定的价格表)

-

如何决定我的汽车保险金额?

汽车保险的金额需要依照汽车的市场价值而定。市场价值代表你的汽车的价值,其中就包括了汽车的损耗和折旧价

-

综合型保险的主要不承保项目?

该保单不会为投保人提供以下保障:

意外事故造成投保人的伤亡;

投保人的汽车内的乘客;

因自然灾害如水灾、风暴或是土崩所造成的损失、破坏和责任。

-

什么“无索赔奖金“?

无索赔奖金是一种特殊折扣。一般上,都是给予在一年内没有申请索赔的投保人

-

什么是 “excess”?

大部分的保单都有excess, 也就是投保人在一场索赔当中需要缴付的费用。Excess分为两种,一种是强制性的,是由保险公司要求增加的;另一种是自愿性的。你常看到的“total excess” 就是结合了这强制性和自愿性的Excess,而这个金额就是你在一次索赔当中需缴付的费用。

-

什么是”Loading”?

Loading是一项保险费用当中的额外金额。这一项金额是在高风险者的保险费当中。一般上,Loading 是因为投保人容易遭受到某种风险所造成的损失而产生的加额保障。

-

为什么未索赔折扣(NCD)和我的记录有差?

NCD 会有所不同可能是因为有人提出索赔或是被保险人要求NCD转移到另一辆汽车上。你也通过以下网址来查询你现今的NCD率:Ncd Checker

-

什么是市场价值保险加额(Market Value Coverage)?

市场价值是保险公司根据你的汽车在公开市场上所预计的金额。假设你的汽车发生任何事情,你所得到的赔偿是依据当时汽车的市值。普遍上,市场价值保险加额的保险费比较低。

-

什么是协定保险加额(Agreed Value Coverage)?

协定保险加额是你和保险公司之间协商同意的金额。假设你的汽车被注销或被盗窃,你可以通过协定保险金额让保险公司赔偿。普遍上,协定保险加额的保险费比较高。

-

Is there any after sales & claims services offered to customer after insurance purchase?

No after sales services are offered after insurance purchase. You may contact your chosen insurance company for after sales services.

-

Can I purchase this product direct from insurance company?

Yes, to purchase direct from your preferred insurer, you may contact insurer or visit insurer’s website or walk-in to nearest insurer’s branch

-

延保是什么?为什么我们需要它?

您的强制性车险可以在您的车辆出了事故或者被盗窃的时候为您提供保障,但不会在汽车发生故障的时候为您报销。购买一份

延保能在您的车辆意外故障时让您减轻负担,为您提供索赔。Warranty Smart,值得您的信赖。

-

为什么选择 Fincrew 延保?

✓ 值得信赖 – Warranty Smart是车辆延保行业的先驱者,2013年创立于马来西亚,现已将业务扩展到了泰国和印度尼西亚。

✓ 有保障 – 由首屈一指的保险公司Pacific & Orient Insurance Co.Berhad (P&O)承保。

✓ 够专业 – 我们在全国有超过182个指定车厂,构建了最大的技术网。

✓ 便利 – 我们在任何车厂,指定或非指定的车厂提供服务

-

保单涵盖了什么?

我们有许多不同的保单类型。在Warranty Smart, 我们的价格是透明的。因此您可以参考网站上列出的每个保单详情。您可以选择保单内容,或者联系我们专业的销售代表 @+6018 228 8606 来为您的爱车选择最佳的保险方案。

对于现有会员,请参考您的保单内容来查阅具体覆盖范围。

-

申请车辆索赔时,你们会用什么样的零件来维修替换?

车辆维修将全权由Warranty Smart自行决定,Warranty Smart 有权维修/翻新损坏的零件,或者用使用过的,翻新的或者OEM零件来替换损坏的零件。

然而,如果您要求更换全新零件,您可以在维修前与我们的索赔调度员联系沟通。只有在您同意补上全新零件与用过的/修复的/OEM零件的差价时,才能替换全新的零件。

-

保险套餐中的索赔限额是什么?

每一种保险套餐都有独立的索赔限额。

比如,黄金套餐每单索赔限额为RM10,000,总索赔限额达RM50,000。这意味着,每单最高索赔RM10,000,在承包期内,不限索赔次数,只要索赔总额没有超过RM50,000。在同一个零件上申请重复索赔是可以的。

-

Fincrew / Warranty Smart支付人工费用吗?

当然了。索赔的所有费用中,我们会承担零件费用和人工费用。

-

保单中什么费用是不涵盖的?

基本上,每项保单详情中没有列出的部分都不涵盖在保险内。所有的延保服务往往都不含正常使用所致损坏的零件,例如,过滤器,火花塞,各种液体,刹车片,以及轮胎等等。

-

购买保险前需要检查我的汽车吗?

需要。我们提供免费的车检服务。

• 居住在巴生谷的顾客,可以预约免费的上门车检服务。

• 居住在巴生谷以外的顾客,可以将车送至距离最近的,由我们授权的车厂进行车检。

-

如何知道我的车是否有资格购买延保服务?

G通常,Warranty Smart的套餐适用于车龄不超过十年,且里程表读数在150,000公里以内的车辆。如果您的车辆自生产年份已超过十年,或者里程数超过150,000千米,我们会在车检时评估您的车辆状况是否够格。

-

完成购买后,我的保单什么时候开始生效?

保险的生效日期和里程数会在保单上注明。与其它延保公司不同的是,我们没有任何冷却期。这意味着您可以从保险生效日期开始立即申请索赔。

-

发生故障时提供拖车吗?

车主需使用自己车辆的保险进行拖车。

拖车必须送至授权保修智能维修厂,方可办理索赔。

-

如何知道我的车辆问题是否在承保期内可以索赔?

可以将车辆运至最近的授权车厂来检查/诊断,这项服务是免费的。车厂将联系我们的索赔部门来判断该故障是否在保单承保范围内。

-

如何申请索赔?

在Fincrew, 我们致力于实现轻松索赔流程。直接联系我们的索赔部分@ +6018 228 8606.。一位专属的索赔顾问将会引导您完成整个流程。

已经在我们授权车间?车间会判断故障的原因,只要是在保单覆盖范围内,它会为您提供服务。

-

我需要预先支付吗?

不用。您不需要为已批准的索赔付款。我们会让您的车辆快速上路,无需等待报销。一旦维修完成,我们会直接付款给维修车间。您只需承担保单不涵盖部分的费用(如果有产生的话)。

-

如果查询索赔状态?

您可以直接拨打电话或者通过whatsapp联系我们的索赔部门 @ +6018 228 8606,即刻获得车辆维修的最新信息。

-

如果一个故障不在保单范围内?

如果故障不在您的保单范围内,我们仍可以帮助您。我们将充当您在维修过程中的联系人,帮您推荐,以确保您在整个过程中没有被占便宜。我们不是只对您销售保险,我们为您提供全力支持。

-

如果我申请了索赔,下次续保的时候保单会涨价吗?

当然不会。无论您申请了多少次索赔,您的保单都不会涨价。同样的,对于所有延保套餐,即使您没有申请过任何索赔,续保时也没有优惠。

-

可以去哪里维修车辆?

为了客户的方便,Fincrew / Warranty Smart 采用了“开放服务”这一概念。您可以在您偏爱的车厂进行所有的日常维护,无论是我们指定的还是非指定的。

只需要确保“故障确认和索赔环节”是在我们指定的车厂进行的。

-

我需要做什么来使保单一直处于生效状态吗?

• 您需要及时的进行每次的例行维护,以及将保存好所有的维修记录,在您的保修服务手册上(印有车厂印章)。

• 确保妥善保管好您的维修服务手册。如果您的手册丢失了,请立即联系我们替换一本手册,费用RM100。记录手册在申请索赔时是必须的。

• 请勿在保修期内滥用、忽视、以及改装您的车辆。

-

如果我转手了我的车,可以将保单过户给新车主吗?

当然!保单是锁定车辆的,与所有者无关。这也意味着为您的车辆购买延保,实际也在为您的车辆增值。

-

我可以取消我的保单吗?

一旦您的保单开始生效,是无法退款,以及无法过户到其它车辆上的。

-

Why Consider Getting Auto Service Finance in Malaysia?

The auto service financing program provides a readily accessible personal loan for car repairs you can leverage when in a bind. You can return the sum used in a small monthly payment form. The reasonable loan terms afforded to ensure that you have a backup for funds if you ever have trouble with your car.

-

How is This Program Shariah-Compliant?

As you won’t have to deal with interest charges, mull over interest rates, or do anything considered Haram, this financing option is one fit for a true Muslim believer to consider.

-

How Fast Can I Get Approval For This Financing Option?

You can get approval for these auto repair loans in under a minute. However, it can sometimes take as long as 15 minutes.

-

What Are the Requirements For Getting This Equity Loan?

You need to be between 18 and 65 years of age. Also, you need a valid bank account. However, you can secure this funding without a credit card.

-

Can I Get My Auto Repairs Once My Application Has Been Approved?

Yes, you can. But keep in mind that you have access to a specific loan amount. So, you need to make sure you know how much credit you can get before you make any appointments with a registered workshop.

-

What’s the Profit Rate of This Auto Repair Finance Loan?

This value depends on the condition of your Credit Score, but it’s usually between 0.8 and 1.5% monthly.

-

What’s the Loan Amount Range For This Financing option?

With this lending feature, you can get a minimum of RM 100 and a maximum of RM 5 000.

-

What Loan Tenure Can I Expect?

This variable is usually determined at the discretion of the Financier.

-

Must the Financier Physically Sign Off on the Loan Terms?

No, this isn’t necessary.

As provisions have been made for digital signing, the transaction can be completed from any preferred location.

-

Do These Auto Repair Loans Require Collateral or a Guarantor?

No, they don’t.

-

Can I Fully Settle the Loan Before Maturity?

Yes, you can.

However, you must first give a 1-week written notice so all the necessary documents to legalize that action can be prepared. After you’ve done this and eventually settled the financing, you’ll receive a rebate for the deferred financing.

-

Is Direct Lending Legit?

Yes, it is.

As the Financier of this facility, Direct Lending Sdn Bhd has all the necessary licensing and certification to carry out such activities in Malaysia. In addition to being registered under the Ministry of Housing and Local Government, it’s also duly recognized by Cradle Fund Sdn Bhd and the Malaysian Global Innovation & Creativity Centre (MaGIC).

-

What’s the Partnership Between FinCrew and Direct Lending?

FinCrew is currently the official partner in sales to Direct Lending and is actively involved in helping make the auto service finance facility more readily available to Malaysians.

See more information here.

-

Is it Legal to Apply For the Loan Through FinCrew? Is That Ah Long?

Yes, it is.

As FinCrew is an official partner of Vanta and Boost Credit, you won't be breaking any rules if you apply for a small business loan with us because both partners are big names operating entirely within the confines of the law.

-

How Does an SME Loan Work?

A small and medium-sized enterprise loan is a type of funding designed to cater to SMEs that meet specific criteria. As such, it typically doesn't require collateral. You can easily access such services if your business meets the requirements and can find an excellent Financier.

-

Why Are SME Loans a Better Alternative to an Investment?

Because SME loans help you achieve a lot more, for example, they help you expand faster, get a better position to capitalize on various emerging economies, and even enhance your creditworthiness.

-

What is the Purpose of an SME Loan?

The main purpose of these loans is to support the financial needs of a small or medium-sized establishment.

-

What Credit History is a Factor for an SME Business Loan?

The most crucial credit history here is your Credit Score. However, how much this variable matters will vary from one financial institution to another.

-

What is the Tenure of an SME Business Loan Repayment?

Again, this depends on the financial institution; however, the loan tenure is usually from 12 months to 7 years.

-

How Much SME Business Loan Do I Qualify?

There's no fixed value for this as several variables influence the size of the loan amount you can get. It includes factors like the size of your annual income, your Credit Score, and type of business. For instance, if you own an Sdn Bhd company, you can choose either Boost Credits or Vanta Capital. But if your company is sole proprietorship, you can opt for Boost Credits, which have a lower entry-point for the loan.

For Sole proprietors, enterprises, and any kind of company:

- Boost Credits

- Minimum 1k to maximum 100k of loan

- Full digital AI approval process within 3 minutes

- For larger companies (Only Sdn Bhd)

- Vanta Capital

- Minimum 200k to maximum 10 millions of loan

-

Why Are Loans Important to Businesses?

Because it gives businesses the resources they need to better themselves, especially in developing countries.

-

Why is it Difficult For Small Businesses to Get Loans?

It is often due to several reasons, including insufficient credit lines, limited cash flow, and too many work applications.

-

How Long Should it Take to Process an SME Business Loan?

It depends on the financial institution. For example, FinCrew can get you the resources you need in 24 to 48 hours, and it usually takes much longer for many other financial institutions in Malaysia. Take the first steps towards securing that business today!

-

What Is a Koperasi Loan?

A koperasi loan (or a Cooperative loan) is a type of credit service from Cooperatives or Foundations (Yayasan) that’s available only to civil servants working in the government, local municipal councils, as well as selected government-linked bodies. Credit cooperatives are registered with the Cooperative Commission of Malaysia (SKM) and regulated under the Cooperatives Act of 1993.

-

Who Runs Koperasi Loans?

Only civil servants and selected staff members who work for federal or state governments, municipal workers, statutory bodies, government-linked agencies and others. Each cooperative loan will have a list of employers who are eligible to apply; for example this includes members of organisations such as PKNS, SYABAS, TNB (Tenaga Nasional Berhad), public universities, and many more.

Koperasi loan providers may also require that civil servants be employed for at least six months at said government body. You can apply for a koperasi loan if you are 21 (some providers have a lower minimum age of 18), up to 58 years of age. A monthly wage of RM1,500 is usually set as the minimum required to be eligible to apply for a koperasi loan. Private sector employees and those who run their own businesses are not entitled to apply for koperasi loans.

-

What Are The Credit Criteria To Fulfill When Applying For a Koperasi Loan?

It is less strict compared to conventional bank loans. Cooperative loans tend to set a slightly lower credit approval criteria as loan repayments are directly deducted from the borrower’s salary by Biro Perkhidmatan ANGKASA (via SPGA – Sistem Potongan Gaji BPA) or the Accountant General’s Department.

Koperasi loans are attractive to civil servants because those with a less-than-stellar CTOS records, blacklisted in CCRIS (with a Special Attention Account) and even registered with AKPK are still eligible to borrow. Furthermore, loan applicants with high payment commitments or debt service ratio (DSR) will also be considered by koperasi loan providers, unlike conventional loans.

-

How Does The Repayment Work?

Monthly repayments are conducted via an automatic salary deduction scheme by the National Cooperative Movement of Malaysia, or better known as Biro ANGKASA as mentioned previously. Likewise, some koperasi loans also accept deductions via the Accountant General’s (AG) Department. The Public Services Department imposed a rule that loan instalments plus other deductions cannot exceed a set limit of 60%; this was designed such that the borrower’s take-home pay is at least 40% of his or her gross salary to ensure that a decent standard of living is still possible.

-

What Are The Loan Tenures Available?

Koperasi loan tenures are up to a maximum of 10 years, as stipulated by the government. Conventional bank loans, on the other hand, usually only reach seven years.

-

How High Are The Interest Rates And The Payouts Available?

Interest rates (or profit rates, if they are Islamic-based) are also lower than most banks; expect as low as 3.88% per annum from selected koperasi loan providers. You will also need to take into account the potential loan payout available to you. One can borrow up to RM250,000 or the maximum installment amount that can be deducted from the borrower’s pay. However, it is important to note that the loan sum disbursement is rarely 100%, and you can expect anything between 70% to 98%. This is dependent on the koperasi loan provider chosen. Therefore it’s important to first work out how much the monthly repayment will be before signing up for the loan.

-

What Are The Documents Requested?

- Photocopy of NRIC, verified by employer

- Latest three months’ pay slip

- Verified letterhead from the employer

- Bank statements

- Copy of a utility bill (Tenaga, ASTRO, etc)

- Photocopy of Bank savings account book (could vary depending on the underwriter of the loan)

Different providers would request for a combination of documents for your application, but it’s best to prepare these in advance. Keep in mind that multiple copies of these documents are often requested for, so remember to keep additional copies at hand when forwarding your application.

-

What Can I Use The Koperasi Loan For?

Weddings, unexpected bills, vacation, renovation, emergency situations, almost anything. But of course, Finder expects you to be a savvy spender – a wise one always sets out to plan and manage his or her finances for the future.

-

How Else Is a Cooperative Loan Different From Your Regular Commercial Bank Loan?

The majority of cooperative loans are Islamic-based and therefore Shariah-compliant. Being grounded on Islamic banking and finance principles such as Tawarruq and Murabahah means that the sale and purchase of commodities is payable by instalments or deferred payments. Many koperasi loans also come with compulsory takaful insurance protection to ensure that any outstanding amounts in the circumstances of death or total permanent disability can be accounted for.

-

What is the relationship between Fincrew and the insurance company?

Fincrew is a platform for user to research, compare and purchase insurance. We work with our vendors which represent multiple insurance companies to provide the most up-to-date of insurance products in Malaysia. We are not a subsidiary or affiliated company with any insurance company in Malaysia.

-

Is Fincrew a legal business entity in Malaysia?

Yes, Fincrew is registered with SSM and owned by Fincrew Sdn Bhd 202101032014 (1432314-W) and is governed by the laws of Malaysia in our business operations.

-

How do I know that it's safe to buy insurance online? Will my personal

info be secured?

All data submitted to us are processed by our internal team and viewed only by the insurer selected by you. We strongly support the

Personal Data Protection Act (PDPA), which dictates that we keep your information private & confidential and prevent them from any misuse in any way whatsoever. You may also see our

Privacy Policy.

-

Will I receive any call from Fincrew ?

We understand that receiving tele-sales call can be annoying so we will not call you to upsell any products. We will only call you if there’s a need to, like example: on claim related matter. However, you may still contact us if you need help on any issue. Our dedicated customers’ service team is always ready to assist you.

-

What are some of the key terms and conditions that i should be aware of?

Importance of Disclosure

You must disclose all material facts that you know or ought to know such as your personal pursuits and medical condition which could affect the risk profile; otherwise your policy may be invalidated.

Cash before cover

Full premium must be paid and received by us before the effective date of the policy. If this condition is not complied with then this insurance policy is automatically null and void

-

Do I need to type in my details again if I'd like to buy again in the

future?

No, you don’t need to. Our system is designed to auto create an account for each success buyer. You can check your mailbox for the login details or

contact us to request for your account details.

-

Help! I made a mistake on my personal info when I was buying insurance.

-

If I have an enquiry on any products or any other questions, who should I

refer to?

-

What do I need to do if there are changes to my contact/personal details?

It is important that you inform us of any changes in your contact and personal details to ensure that all correspondence reach you timely manner.

-

How do I lodge a complaint if I'm unhappy with the product or services?

Please do not hesitate to

contact us with your feedback, and we'll try to resolve the matter.

-

Can I buy this insurance online with a supplementary credit card?

Yes, you can.

-

How can I pay for the policy I buy?

You can pay online through credit card, debit card or e-banking.