Insurans boleh menjadi subjek yang rumit untuk difahami. Namun, ia akan membantu jika anda memahaminya dengan baik, jadi anda akan tahu sama ada untuk menerima produk atau ervis yang ditawarkan oleh mana-mana syarikat insurans. Untuk itu, adalah penting untuk mengetahui apa yang perlu ditanya kepada ejen insurans apabila anda merancang untuk mengambil apa-apa polisi dengan mereka. Sama ada anda ingin membeli insurans hayat atau mendapatkan perlindungan untuk kereta anda, ini adalah semua yang anda perlu tahu untuk memahami cara polisi insurans berfungsi di Malaysia.

-

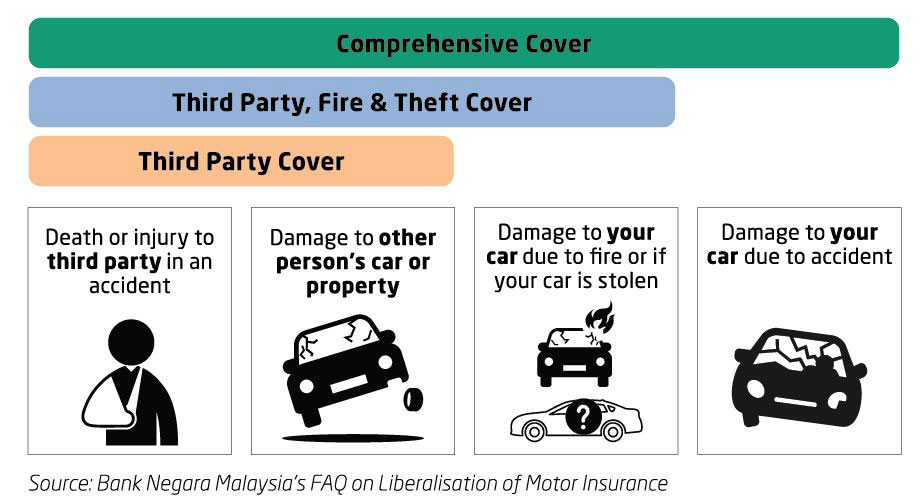

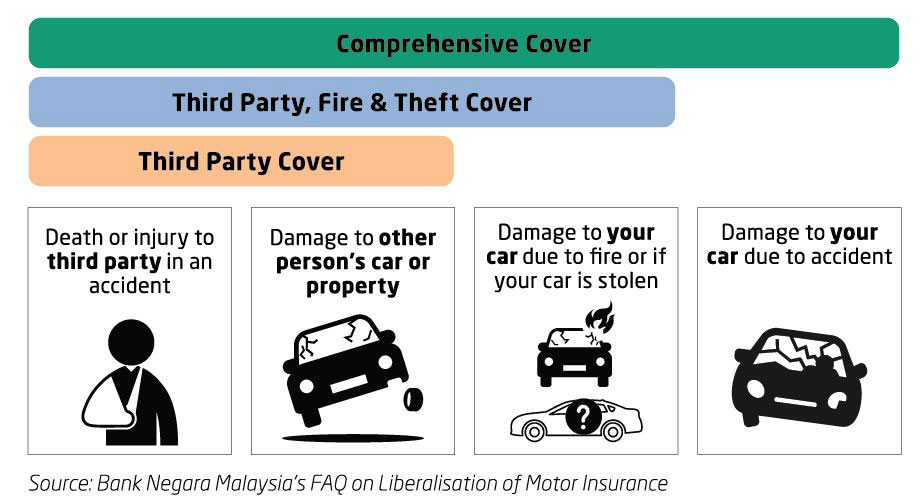

Apa itu polisi insurans motor komprehensif?

Polisi ini memberikan perlindungan terhadap kerosakan keatas kenderaan anda/atau liabiliti anda kepada pihak lain seperti kecederaan atau kematian dan kerosakan kepada harta benda pihak lain disebabkan oleh kemalangan motor.

-

Bagaimana premium Insurans Auto saya akan dikira?

Premium insurans akan dikira berdasarkan ciri-ciri risiko. Lebih besar potensi risiko, lebih tinggi nilai premium. Lebih rendah potensi risiko, lebih rendah nilai premium

-

Apa itu Liberalisasi Insurans Auto?

Ini bermakna harga insurans motor tidak lagi bergantung pada Tarif Motor (satu set senarai harga tetap).

-

Bagaimanakan saya menentukan jumlah yang diinsuranskan untuk kereta saya?

Jumlah yang diinsuranskan hendaklah berdasarkan nilai pasaran kereta anda. Nilai pasaran mewakili nilai kereta anda dengan elaun untuk haus dan lusuh atau susut nilai.

-

Apakah pengecualian utama untuk Insurans Auto Komprehensif?

Polisi ini tidak melindungi beberapa kerugian seperti:

- Kematian pemegang polisi atau kecederaan badan akibat kemalangan motor.

- Liabiliti pemegang polisi terhadap tuntutan daripada penumpang dalam kenderaan anda dan,

- Kerugian, kerosakan atau liabiliti yang muncul akibat bencana alam iaitu banir, ribut atau tanah runtuh.

(Nota: Senarai ini tidak lengkap. Sila rujuk kepada kontrak polisi untuk senarai penuh pengecualian di bawah polisi ini)

-

Apa itu Bonus Tanpa Tuntutan (NCB)?

Bonus Tanpa Tuntutan adalah diskaun istimewa yang diberikan setiap tahun jika tidak ada sebarang tuntutan.

-

Apa itu lebihan?

Kebanyakan polisi ini termasuk dengan lebihan, iaitu jumlah yang perlu dibayar oleh pemegang polisi sekiranya berlaku tuntutan. Terdapat dua lebihan wajib, yang dikenakan oleh syarikat insurans dan lebihan sukarela. Frasa ‘jumlah lebihan’ menggabungkan kedua-dua faktor ini dan merupakan amaun yang anda bayar sekiranya berlaku tuntutan.

-

Apa itu caj tambahan atau ‘loading’?

Loading ialah jumlah tambahan yang dimasukkan dalam kos insurans. Jumlah ini ditambah kepada premium untuk menyediakan perlindungan bagi individu yang ‘berisiko’. Pada asasnya, ‘loading’ melindungi kerugian yang timbul daripada menginsuranskan individu yang terdedah kepada satu bentuk risiko dan kerugian untuk tempoh tersebut dan kerugian untuk tempoh tersebut dijangka lebih tinggi daripada yang diharapkan.

-

Mengapakah Diskaun Tanpa Tuntutan (NCD) yang diberikan adalah berbeza daripada rekod saya?

NCD yang diberikan adalah berbeza jika terdapat tuntutan yang dibuat atau jika terdapat pengeluaran NCD untuk dipindahkan ke kereta lain atas permintaan pemilik insurans. Sebagai alternatif, anda juga boleh mnyemak kadar NCD semasa anda melalui Penyemak NCD.

-

Apa itu perlindungan Nilai Pasaran?

Nilai Pasaran ialah jumlah berdasarkan anggaran syarikat insurans tentang nilai kereta anda di pasaran terbuka. Sekiranya terjadi sesuati ke atas kereta anda, anda hanya boleh menuntut sehingga nilai/harga pasaran semasa model kereta anda pada masa itu. Secara umumnya, premium perlindungan Nilai Pasaran cenderung lebih rendah.

-

Apa itu perlindungan Nilai Yang Dipersetujui?

Nilai yang Dipersetujui ialah jumlah yang telah dipersetujui antara anda dengan syarikat insurans anda. Jika berlaku sesuatu kepada kereta anda, perlindungan nilai yang dipersetujui pastinya boleh memberikan pampasan yang akan anda terima daripada syarikat insurans sekiranya kereta anda dilupuskan atau dicuri. Secara umumnya premium perlindungan Pasaran yang Dipersetujui cenderung lebih tinggi.

-

Is there any after sales & claims services offered to customer after insurance purchase?

No after sales services are offered after insurance purchase. You may contact your chosen insurance company for after sales services.

-

Can I purchase this product direct from insurance company?

Yes, to purchase direct from your preferred insurer, you may contact insurer or visit insurer’s website or walk-in to nearest insurer’s branch

-

Apakah Program Jaminan Lanjutan & Mengapa Anda Memerlukannya?

Insurans kereta wajib anda melindungi anda sekiranya berlaku kemalangan atau kecurian, tetapi tidak akan membayar untuk kerosakan kereta. Menambah pelan

jaminan lanjutan memberi anda perlindungan tambahan terhadap kerosakan yang tidak dijangka dan kos serta tekanan yang datang bersamanya. Dengan insurans serta Warranty Smart, anda benar-benar memiliki perlindungan yang menyeluruh.

-

Mengapa memilih Warranty Smart?

✓ KREDIBILITI – Warranty Smart ialah perintis dalam industri jaminan lanjutan kereta, pertama kali ditubuhkan di Malaysia sejak tahun 2013 dan telah mengembangkan operasinya di Thailand dan Indonesia.

✓ DIINSURANSKAN – Oleh penanggung insurans terkemuka, Pacific&Orient Insurance Co. Berhad (P&O)

✓ KEPAKARAN – Kami mempunyai rangkaian kepakaran teknikal terbesar dengan lebih 182 bengkel panel di seluruh negara.

✓ KEMUDAHAN – Kami membenarkan konsep PERKHIDMATAN TERBUKA di mana-mana bengkel, panel atau bukan panel.

-

Apakah yang dilindungi oleh jaminan?

Kami mempunyai pelbagai pelan berbeza yang tersedia.Di Warranty Smart, kami mengamalkan ketelusan kepada pengguna kami, justeru perlindungan yang disenaraikan dalam laman web kami untuk setiap pelan masing-masing. Anda boleh memilih tahap perlindungan atau bercakap dengan wakil jualan kami yang berpengetahuan @ +6018 228 8606 untuk membantu anda memilih pelan yang sesaui untuk kenderaan anda.

Untuk ahli sedia ada, sila rujuk polisi jaminan anda untuk komponen yang terperinci yang dilindungi

-

Apakah jenis alat ganti yang akan anda letakkan pada kenderaan saya ketika tuntutan?

Pembaikan jaminan akan dibuat sepenuhnya mengikut budi bicara Warranty Smart yang berhak sama ada untuk membaiki/mengubah komponen yang rosak, atau menggantikan komponen yang rosak dengan bahagian terpakai, dibaik pulih atau OEM. Bagaimana pun jika anda berhasrat untuk meminta alat ganti yang baru, anda boleh menghubungi penyelaras tuntutan kami sebelum memulakan tugas tuntutan. Penggantian sedemikian hanya boleh dilakukan jiks anda bersetuju untuk menambah nilai antara bahagian baharu dan bahagian terpakai/dibaik pulih/OEM

-

Apakah yang dimaksudkan dengan had tuntutan pada pelan jaminan?

Setiap jenis pelan jaminan mempunyai had tuntutan masing-masing.

Sebagai contoh, pelan GOLD mempunyai had RM10,000 bagi setiap tuntutan dengan jumlah tuntutan agregat sehingga RM50,000. Ini bermakna RM10,000 ialah had maksimum bagi setiap tuntutan dan anda boleh memiliki bilangan tuntutan tanpa had sepanjang tempoh jaminan anda, selagi ia berada dalam komponen yang dilindungi dan selagi jumlah had tuntutan anda sebanyak RM50,000 masih mempunyai baki yang tersedia. Tuntutan berulang juga dibenarkan untuk tuntutan yang sama.

-

Adakah Fincrew / Warranty Smart membayar untuk caj Upah?

Tentu sekali. Untuk semua tuntutan yang dilindungi, kami akan menguruskan kedua-dua kos alat ganti dan upah.

-

Bahagian manakah yang TIDAK dilindungi oleh jaminan?

Secara amnya, mana-mana bahagian yang tidak disenaraikan di bawah komponen yang dilindungi bagi setiap jenis pelan jaminan tidak boleh dituntut. Semua polisi jaminan lanjutan cenderung tidak termasuk item haus dan lusuh seperti penapis, palam pencucuh, cecair, pad brek, tayar dan sebagainya.

-

Adakah saya perlu memeriksa kenderaan saya sebelum membeli?

Ya. Kami akan menyediakan khidmat pemeriksaan PERCUMA ke atas kenderaan anda untuk diluluskan.

• Untuk lokasi di Lembah Klang, anda boleh membuat temujanji untuk khidmat pemeriksaan dari pintu-ke pintu kami.

• Untuk lokasi di luar Lembah Klang, anda boleh menadu ke mana-mana bengkel panel sah kami yang berhampiran dengan anda!

-

Bagaimanakah untuk saya tahu sama ada kenderaan saya layak untuk membeli pelan jaminan lanjutan?

Secara amnya, pelan Fincrew layak untuk kenderaan sehingga usia 10 tahun dari tahun pembuatannya dan dalam bacaan odometer 150,000km. Jika kenderaan anda melebihi usia 10 tahun dari tahun pembuatan, atau bergerak lebih daripada 150,000km, kami akan menilai kelayakan anda berdasarkan keadaan kenderaan semasa pemeriksaan kami.

-

Bilakah perlindungan saya bermula setelah pembelian?

Tarikh permulaan dan jarak tempuh anda akan dinyatakan pada polisi jaminan anda. Tidak seperti syarikat jaminan lanjutan yang lain, kami tidak menggunakan sebarang tempoh penyejukan. Ini bermakna anda boleh menuntut hampir serta-merta dari tarikh bermulanya jaminan.

-

Adakah khidmat tunda disediakan apabila kerosakan berlaku?

Pemilik perlu menggunakan insurans kenderaan sendiri untuk penundaan.

Penundaan hanya dibenarkan ke Panel Pintar Jaminan yang Dibenarkan untuk tujuan tuntutan.

-

Bagaimana untuk saya tahu jika masalah kereta saya boleh dituntut di bawah jaminan?

Anda boleh membawa kereta anda ke panel sah kami yang terdekat untuk pemeriksaan/diagnos dan perkhidmatan ini adalah PERCUMA! Panel akan menghubungi jabatan tuntutan kami untuk menentukan sama ada kerosakan itu melibatkan item yang dilindungi di bawah pelan jaminan anda.

-

Bagaimana cara untuk saya memfailkan tuntutan?

Di Fincrew, kami berusaha untuk memproses tuntutan tanpa kerumitan. Hanya hubungi bahagan tuntutan kami @ +60182280133. Penasihat tuntutan akan membimbing anda melalui proses tersebut.

Sudah berada di panel sah kami? Panel akan menentukan punca kegagalan dan selagi ia adalah komponen yang dilindungi, ia akan diuruskan untuk anda!

-

Adakah saya perlu membayar pendahuluan untuk tuntutan?

Tidak. Anda tidak perlu membayar untuk tuntutan yang diluluskan. Tidak perlu menunggu untuk bayaran balik kerana kami akan membawa anda kembali ke jalan raya dengan pantas! Setelah baik pulih selesai, kami akan terus membayar bengkel panel. Anda hanya perlu bertanggungjawab terhadap caj yang tidak dilindungi (jika ada)

-

Bagaimana untuk saya memeriksa status tuntutan saya?

Anda boleh menelefon/whatsapp terus jabatan tuntutan @ +60182280133 untuk kemaskini status baik pulih segera!

-

Apakah yang akan terjadi jika bahagian tersebut tidak dilindungi?

Jika masalah tersebut tidak berada dalam pelan perlindungan jaminan anda, kami masih di sini untuk membantu anda. Kami akan bertindak sebagai penghubung anda untuk proses pembaikan, membuat cadangan, dan memastikan anda tidak diambil kesempatan. Kami bukan hanya menjual jaminan kepada anda, kami juga akan membantu anda sepenuhnya!

-

Jika saya memfailkan tuntutan, adakah premium saya akan meningkat selepas ini apabila saya memperbaharui tuntutan saya?

Tentunya tidak. Tidak kira berapa kerap anda memfailkan tuntutan, premium anda tidak akan meningkat. Juga, dikaun tanpa tuntutan tidak tersedia untuk semua pelan jaminan lanjutan.

-

Di manakah saya boleh membawa kereta saya untuk diservis?

Fincrew / Warranty Smart mengamalkan konsep "SERVIS TERBUKA' untuk kemudahan anda! Anda dibenarkan untuk mengekalkan semua servis rutin di mana-mana bengkel pilihan anda sendiri, tidak kiralah ia adalah bengkel panel kami atau bukan. Hanya semak untuk kerosakan dan tuntutan item yang dilindungi mesti dilakukan di bengkel panel sah kami.

-

Apakah tanggungjawab saya untuk memastikan waranti saya aktif?

• Anda perlu mengekalkan servis rutin anda tepat pada masanya dan menyimpan rekod yang betul untuk semua penyelenggaraan dalam buku kecil servis jaminan anda (setem bengkel)

• Pastikan untuk menyimpan buku kecil servis jaminan anda dengan selamat. Jika buku kecil anda hilang, sila laporkan kepada kami dengan segera untuk mendapatkan buku ganti dengan caj RM100. Buku kecil ini adalah wajib jika ingin membuat tuntutan.

• Jangan menyalah guna, mengabaikan atau mengubah suai kenderaan anda semasa tempoh jaminan.

-

Bolehkah saya memindahkan jaminan saya ke pemilik baru jika saya menjual kereta saya?

Sudah pasti! Jaminan kekal bersama kenderaan walaupun berlakunya pertukaran hak milik. Ini bermakna, jaminan kereta anda boleh menambah nilai untuk jualan kereta terpakai anda.

-

Bolehkah saya membatalkan jaminan saya?

Sebaik sahaja pelan kaminan anda diaktifkan, ia tidak boleh dikembalikan dan tidak boleh dipindah milik ke kenderaan lain.

-

Kenapa saya memerlukan insurans perjalanan?

Adalah penting untuk memiliki insurans perjalanan semasa anda melancong seandainya berlaku kemalangan, sakit atau kehilangan barang peribadi. Anda boleh membanding dan mendapatkan perlindungan komprehensif daripada syarikat insurans yang berbeza di Fincrew.

-

Apakah yang dilindungi oleh insurans perjalanan?

Insurans perjalanan menyediakan perlindungan kemalangan, sakit atau kehilangan barangan peribadi dan sebagainya. Sesetengah syarikat insurans menyediakan faedah tambahan seperti pembatalan perjalanan, perlindungan pandemik atau peralatan sukan.

-

Apakah keadaan perubatan sedia ada (pre-existing condition)?

Keadaan perubatan yang telah terjadi sebelum insurans seseorang itu berkuat kuasa.

-

Bilakah saya perlu membeli insurans perjalanan?

Anda perlu membeli insurans perjalanan anda sebelum memulakan perjalanan dan adalah dinasihatkan memulakan 1 hari atau lebih awal sebelum perjalanan anda.

-

Adakah insurans perjalanan melindungi bencana alam?

Kebanyakan insurans perjalanan melindungi bencana alam dan tertakluk kepada terma dalam polisi. Adalah penting untuk membandingkan insurans perjalanan anda di Fincrew.

-

Berapa lamakah insurans perjalanan akan bertahan?

Sesetengah syarikat insurans melindungi sehingga 190 hari untuk perjalanan tunggal dan 90 hari untuk perlindungan perjalanan tahunan. Adalah penting untuk berunding dengan Perkhidmatan Pelanggan Fincrew atau meujuk Brosur Produk atau Kata Polisi daripada syarikat insurans masing-masing.

-

Apakah kegunaan insurans pembatalan perjalanan?

Manfaat ini memberi pampasan kepada anda untuk kerugian perbelanjaan perjalanan dan penginapan akibat pembatalan perjalanan disebabkan kecederaan serius atau penyakit.

-

Bolehkah saya membatalkan insurans perjalanan sekiranya saya membatalkan perjalanan?

Anda boleh menamatkan polisi anda pada bila-bila masa dengan memberikan notis bertulis kepada syarikat insurans dalam tempoh empat belas (14) hari atau menghubungi Pusat Khidmat Pelanggan kami di

sini. Penamatan tersebut akan berkuat kuasa pada tarikh notis tersebut diterima oleh syarikat insurans atau tarikh yang dinyatakan di dalam notis, yang mana lebih awal. Premium tidak akan dikembalikan selepas pembatalan perlindungan.

-

Apa itu Insurans Kemalangan Diri?

Insurans kemalangan diri ialah insurans yang boleh diperbaharui setiap tahun yang memberikan pampasan sekiranya berlaku kecederaan badan, hilang upaya atau kematian yang disebabkan oleh kejadian yang tidak diduga.

-

Siapakah yang layak membeli insurans kemalangan diri?

Semua rakyat Malaysia, pemastautin tetap Malaysia, pemegang permit kerja, pemegang pas atau bekerja secara sah di Malaysia. Umur seseorang bergantung pada pelan insurans masing-masing.

-

Adakah manfaat perbelanjaan perubatan akan dibayar untuk setiap hilang upaya?

Ya, masing-masing membayar sehingga jumlah yang diinsuranskan untuk perbelanjaan perubatan bagi setiap kemalangan dan had adalah mengikut pelan syarikat insurans masing-masing.

-

Adakah polisi ini masih membayar jika saya memiliki polisi insurans lain yang serupa?

Ya, syarikat insurans masing-masing akan membayar sebagai tambahan kepada polisi lain yang mungkin anda miliki kecuali untuk perbelanjaan perubatan yang telah dibayar balik oleh polisi lain.

-

Bagaimanakah Indemniti Berganda berfungsi?

Indemniti berganda bermaksud manfaat yang perlu dibayar akan berganda jika Orang Yang Diinsuranskan mengalami kematian atau hilang upaya kekal akibat kemalangan semasa dalam perjalanan sebagai penumpang yang membayar tambang dalam mod pengangkutan awam.

-

Bagaimana untuk saya layak bagi Bonus Pembaharuan?

Selagi anda memperbaharui polisi anda dan tiada tuntutan di bawah Kematian Akibat Kemalangan atau Hilang Upaya Kekal pada tahun sebelumnya, % Bonus Pembaharuan bagi Jumlah Prinsipal Diinsuranskan akan diberikan ganjaran. Hanya tuntutan di bawah Kematian Akibat Kemalangan dan Hilang Upaya Kekal akan menjejaskan Bonus Pembaharuan Anda.

-

Berapa lamakah tempoh perlindungan Insurans Kemalangan Diri?

Insurans Kemalangan Diri akan menyediakan perlindungan selama satu (1) tahun.

-

Bagaimanakah anda mengklasifikasikan pekerjaan?

Pekerjaan diklasifikasikan kepada 3 kelas seperti berikut:

Pekerjaan Kelas 1

Mereka yang terlibat dalam bidang pentadbiran profesional, pengurusan, perkeranian dan pekerjaan bukan manual

Pekerjaan Kelas 2

Mereka yang terlibat dalam kerja penyeliaan tetapi tidak terlibat dalam kerja manual

Pekerjaan Kelas 3

Orang yang terlibat sama ada sekali sekala atau secara amnya dalam kerja manual yang melibatkan penggunaan alatan atau mesin.

-

Mengapa Perlu Pertimbangkan Untuk Mendapatkan Pembiayaan Servis Auto Di Malaysia?

Program pembiayaan servis auto menyediakan pinjaman peribadi yang mudah diakses untuk pembaikan kereta yang boleh anda manfaatkan apabila anda mengalami kesukaran daripada segi kewangan. Anda boleh melakukan pembayaran pinjaman dalam bentuk bayaran bulanan yang rendah. Syarat pinjaman yang munasabah ditawarkan bagi memastikan anda mempunyai sandaran untuk dana jika anda mengalami masalah dengan kereta anda.

-

Adakah Program Ini Patuh Syariah?

Memandangkan anda tidak perlu berurusan dengan caj faedah, memikirkan tentang kadar faedah, atau melakukan apa sahaja yang dianggap haram, pilihan pembiayaan ini adalah satu pilihan yang boleh dipertimbangkan oleh mereka yang beragama Islam.

-

Berapa Cepat Saya Boleh Mendapatkan Kelulusan Untuk Pembiayaan Ini?

Anda boleh mendapatkan kelulusan untuk pinjaman pembaikan kereta ini dalam masa kurang seminit. Bagaimanapun, ada kalanya, ia boleh mengambil masa sehingga 15 minit.

-

Apakah Syarat Untuk Mendapatkan Pinjaman Ekuiti Ini?

Anda perlu berumur antara 18 dan 65 tahun. Selain itu, anda juga perlu memiliki akaun bank yang sah. Bagaimana pun, anda boleh mendapatkan pinjaman ini tanpa kad kredit.

-

Bolehkah Saya Mendapatkan Pembaikan Kenderaan Saya, Sebaik Sahaja Permohonan Saya Diluluskan?

Ya, tentunya boleh. Tetapi perlu diingatkan, anda mempunyai akses kepada jumlah pinjaman tertentu. Jadi, anda perlu pastikan bahawa anda tahu berapa jumlah kredit yang boleh anda dapat sebelum membuat temujanji dengan bengkel berdaftar.

-

Berapakah Kadar Keuntungan Pinjaman Kewangan Pembaikan Auto Ini?

Nilai ini bergantung pada keadaan Skor Kredit Anda, tetapi kebiasaannya adalah antara 0.8 dan 1.5% setiap bulan.

-

Apakah Julat Amaun Pinjaman Untuk Pilihan Pembiayaan Ini?

Dengan ciri pinjaman ini, anda boleh mendapatkan minimum sebanyak RM100 dan maksimum RM5,000.

-

Berapakah Tempoh Pinjaman Yang Boleh Saya Jangkakan?

Perkara ini biasanya ditentukan oleh budi bicara Pembiaya.

-

Mestikah Pembiaya Menandatangani Secara Fizikal Syarat Pinjaman?

Tidak. Ianya tidak perlu.

Memandangkan peruntukan telah dibuat untuk tandatangan digital, transaksi boleh diselesaikan dari mana-mana lokasi pilihan.

-

Adakah Pinjaman Pembaikan Kereta Ini Memerlukan Cagaran Atau Penjamin?

Tidak.

-

Bolehkah Saya Menyelesaikan Sepenuhnya Pinjaman Sebelum Tempoh Matang?

Ya, boleh.

Walau bagaimanapun, anda mesti memberikan notis bertulis 1 minggu terlebih dahulu supaya supaya segala dokumen yang diperlukan untuk mengesahkan tindakan ini boleh disediakan. Selepas anda melakukan ini, dan menyelesaikan pembiayaan, anda akan menerima rebat untuk pembiayaan yang ditunda.

-

Adakah Direct Lending Sah?

Ya.

Sebagai Pembiaya kemudahan ini, Direct Lending Sdn. Bhd. Mempunyai semua lesen dan pensijilan yang diperlukan untuk menjalankan aktiviti ini di Malaysia. Selain didaftarkan di bawah Kementerian Perumahan dan Kerajaan Tempatan, ia juga telah diiktiraf oleh Cradle Fund Sdn Bhd. dan Pusat Inovasi & Kreativiti Global Malaysia (MaGIC).

-

Apakah Usahasama Antara FinCrew dan Direct Lending?

FinCrew kini merupakan rakan kongsi rasmi dalam jualan kepada Direct Lending dan terlibat secara aktif dalam membantu menjadikan kemudahan pembiayaan servis auto lebih mudah disediakan kepada rakyat Malaysia. Lihat maklumat lanjut di sini.

-

Bolehkah Saya Menulis Wasiat Tanpa Sebarang Saksi? Adakah Ia Masih Sah?

Untuk menjadikan wasiat anda itu sah, terdapat beberapa langkah khusus yang perlu anda ikuti. Jadi, anda boleh menulis wasiat tanpa kehadiran saksi. Walau bagaimanapun, wasiat anda hanya akan dianggap sah dan tidak boleh dipertikai jika anda menandatangani wasiat tersebut di hadapan saksi. Jadi, walaupun kebanyakkan wasiat disediakan tanpa kehadiran sesiapa, anda memerlukan saksi untuk memastikan untuk memastikan wasiat itu benar-benar sah dan dihormati undang-undang setelah ketiadaan anda. Apabila memilih saksi, perlu diingatkan bahawa mana-mana benefisiari anda tidak akan diiktiraf sebagai saksi.

-

Bolehkah Anda Menulis Wasiat Pada Sebarang Peringkat Umur?

Undang-undang mensyaratkan anda berumur sekurang-kurangnya 18 tahun untuk menyediakan wasiat yang sah. Dengan syarat anda berumur 18 tahun atau lebih, barulah undang-undang akan mengiktiraf wasiat yang anda sediakan.

-

Adakah Wasiat Begitu Penting? Patutkah Anda Menulis Wasiat?

Menyediakan wasiat adalah penting kerana ia menjamin harta pusaka anda apabila anda meninggal dunia dan menjaga insan tersayang yang anda tinggalkan. Dengan wasiat semua orang tahu apa yang anda mahukan, dan sebarang insiden salah faham akan dapat dikurangkan. Anda perlu menulis wasiat kerana ia meletakkan anda dalam kawalan dan membantu anda menguruskan semua urusan anda secara terperinci.

-

Usia Berapakah Yang Baik Untuk Menulis Wasiat Seseorang?

Tidak ada masa yang lebih baik berbanding masa sekarang! Dengan syarat anda berumur 18 tahun ke atas, dan berfikiran sihat, tidak ada salahnya untuk anda menyediakan wasiat. Anda boleh mengemaskini apabila berlaku sebarang perubahan.

-

Adakah Saya Memerlukan Peguam Untuk Melaksanakan Wasiat?

Dengan tegas, undang-undang tidak memerlukan seorang peguam mesti menjadi pelaksana wasiat anda. Hampir semua orang boleh melaksanakan amanat anda, dengan syarat anda menganggap mereka cukup cekap untuk mengendalikan tugasan itu. Setelah menetapkan perkara ini, perlu disebutkan juga bahawa, adalah sering disyorkan bahawa anda mempunyai seorang peguam untuk melaksanakan wasiat anda kerana mereka lebih memahami perkara berkaitan undang-undang dengan lebih baik dan ini memudahkan urusan tersebut.

-

Apa Yang Akan Berlaku Apabila Wasiat Telah Ditandatangani Tetapi Tidak Disaksikan?

Sekiranya wasiat anda tidak mempunyai saksi atau disaksikan dengan sewajarnya, wasiat anda secara automatik akan dianggap tidak sah oleh undang-undang.

-

Dalam Situasi Apakah Wasiat Boleh Dibatalkan?

Terdapat beberapa perkara yang boleh dilakukan pewasiat (anda) yang boleh menyebabkan pembatalan wasiat anda. Sebagai contoh, operasi undang-undang biasa akan membatalkan pilihan jika disediakan sebelum anda mempunyai perkahwinan kedua. Selain itu, memusnahkan wasiat sendiri atau mengarahkan seseorang untuk melakukannya bagi pihak anda boleh menyebabkan dokumen undang-undang dibatalkan.

-

Bolehkah Satu Orang Menulis Dua Wasiat Pada Masa Yang Sama?

Ya dan tidak. Seseorang boleh mempunyai dua wasiat berkuat kuasa pada masa yang sama jika wasiat itu melibatkan dua harta pusaka yang berbeza. Walau bagaimanapun, seseorang tidak boleh mempunyai dua wasiat yang mengawal satu harta pusaka secara serentak.

-

Is it Legal to Apply For the Loan Through FinCrew? Is That Ah Long?

Yes, it is.

As FinCrew is an official partner of Vanta and Boost Credit, you won't be breaking any rules if you apply for a small business loan with us because both partners are big names operating entirely within the confines of the law.

-

How Does an SME Loan Work?

A small and medium-sized enterprise loan is a type of funding designed to cater to SMEs that meet specific criteria. As such, it typically doesn't require collateral. You can easily access such services if your business meets the requirements and can find an excellent Financier.

-

Why Are SME Loans a Better Alternative to an Investment?

Because SME loans help you achieve a lot more, for example, they help you expand faster, get a better position to capitalize on various emerging economies, and even enhance your creditworthiness.

-

What is the Purpose of an SME Loan?

The main purpose of these loans is to support the financial needs of a small or medium-sized establishment.

-

What Credit History is a Factor for an SME Business Loan?

The most crucial credit history here is your Credit Score. However, how much this variable matters will vary from one financial institution to another.

-

What is the Tenure of an SME Business Loan Repayment?

Again, this depends on the financial institution; however, the loan tenure is usually from 12 months to 7 years.

-

How Much SME Business Loan Do I Qualify?

There's no fixed value for this as several variables influence the size of the loan amount you can get. It includes factors like the size of your annual income, your Credit Score, and type of business. For instance, if you own an Sdn Bhd company, you can choose either Boost Credits or Vanta Capital. But if your company is sole proprietorship, you can opt for Boost Credits, which have a lower entry-point for the loan.

For Sole proprietors, enterprises, and any kind of company:

- Boost Credits

- Minimum 1k to maximum 100k of loan

- Full digital AI approval process within 3 minutes

- For larger companies (Only Sdn Bhd)

- Vanta Capital

- Minimum 200k to maximum 10 millions of loan

-

Why Are Loans Important to Businesses?

Because it gives businesses the resources they need to better themselves, especially in developing countries.

-

Why is it Difficult For Small Businesses to Get Loans?

It is often due to several reasons, including insufficient credit lines, limited cash flow, and too many work applications.

-

How Long Should it Take to Process an SME Business Loan?

It depends on the financial institution. For example, FinCrew can get you the resources you need in 24 to 48 hours, and it usually takes much longer for many other financial institutions in Malaysia. Take the first steps towards securing that business today!

-

What Is a Koperasi Loan?

A koperasi loan (or a Cooperative loan) is a type of credit service from Cooperatives or Foundations (Yayasan) that’s available only to civil servants working in the government, local municipal councils, as well as selected government-linked bodies. Credit cooperatives are registered with the Cooperative Commission of Malaysia (SKM) and regulated under the Cooperatives Act of 1993.

-

Who Runs Koperasi Loans?

Only civil servants and selected staff members who work for federal or state governments, municipal workers, statutory bodies, government-linked agencies and others. Each cooperative loan will have a list of employers who are eligible to apply; for example this includes members of organisations such as PKNS, SYABAS, TNB (Tenaga Nasional Berhad), public universities, and many more.

Koperasi loan providers may also require that civil servants be employed for at least six months at said government body. You can apply for a koperasi loan if you are 21 (some providers have a lower minimum age of 18), up to 58 years of age. A monthly wage of RM1,500 is usually set as the minimum required to be eligible to apply for a koperasi loan. Private sector employees and those who run their own businesses are not entitled to apply for koperasi loans.

-

What Are The Credit Criteria To Fulfill When Applying For a Koperasi Loan?

It is less strict compared to conventional bank loans. Cooperative loans tend to set a slightly lower credit approval criteria as loan repayments are directly deducted from the borrower’s salary by Biro Perkhidmatan ANGKASA (via SPGA – Sistem Potongan Gaji BPA) or the Accountant General’s Department.

Koperasi loans are attractive to civil servants because those with a less-than-stellar CTOS records, blacklisted in CCRIS (with a Special Attention Account) and even registered with AKPK are still eligible to borrow. Furthermore, loan applicants with high payment commitments or debt service ratio (DSR) will also be considered by koperasi loan providers, unlike conventional loans.

-

How Does The Repayment Work?

Monthly repayments are conducted via an automatic salary deduction scheme by the National Cooperative Movement of Malaysia, or better known as Biro ANGKASA as mentioned previously. Likewise, some koperasi loans also accept deductions via the Accountant General’s (AG) Department. The Public Services Department imposed a rule that loan instalments plus other deductions cannot exceed a set limit of 60%; this was designed such that the borrower’s take-home pay is at least 40% of his or her gross salary to ensure that a decent standard of living is still possible.

-

What Are The Loan Tenures Available?

Koperasi loan tenures are up to a maximum of 10 years, as stipulated by the government. Conventional bank loans, on the other hand, usually only reach seven years.

-

How High Are The Interest Rates And The Payouts Available?

Interest rates (or profit rates, if they are Islamic-based) are also lower than most banks; expect as low as 3.88% per annum from selected koperasi loan providers. You will also need to take into account the potential loan payout available to you. One can borrow up to RM250,000 or the maximum installment amount that can be deducted from the borrower’s pay. However, it is important to note that the loan sum disbursement is rarely 100%, and you can expect anything between 70% to 98%. This is dependent on the koperasi loan provider chosen. Therefore it’s important to first work out how much the monthly repayment will be before signing up for the loan.

-

What Are The Documents Requested?

- Photocopy of NRIC, verified by employer

- Latest three months’ pay slip

- Verified letterhead from the employer

- Bank statements

- Copy of a utility bill (Tenaga, ASTRO, etc)

- Photocopy of Bank savings account book (could vary depending on the underwriter of the loan)

Different providers would request for a combination of documents for your application, but it’s best to prepare these in advance. Keep in mind that multiple copies of these documents are often requested for, so remember to keep additional copies at hand when forwarding your application.

-

What Can I Use The Koperasi Loan For?

Weddings, unexpected bills, vacation, renovation, emergency situations, almost anything. But of course, Finder expects you to be a savvy spender – a wise one always sets out to plan and manage his or her finances for the future.

-

How Else Is a Cooperative Loan Different From Your Regular Commercial Bank Loan?

The majority of cooperative loans are Islamic-based and therefore Shariah-compliant. Being grounded on Islamic banking and finance principles such as Tawarruq and Murabahah means that the sale and purchase of commodities is payable by instalments or deferred payments. Many koperasi loans also come with compulsory takaful insurance protection to ensure that any outstanding amounts in the circumstances of death or total permanent disability can be accounted for.

-

What is the relationship between Fincrew and the insurance company?

Fincrew is a platform for user to research, compare and purchase insurance. We work with our vendors which represent multiple insurance companies to provide the most up-to-date of insurance products in Malaysia. We are not a subsidiary or affiliated company with any insurance company in Malaysia.

-

Is Fincrew a legal business entity in Malaysia?

Yes, Fincrew is registered with SSM and owned by Fincrew Sdn Bhd 202101032014 (1432314-W) and is governed by the laws of Malaysia in our business operations.

-

How do I know that it's safe to buy insurance online? Will my personal

info be secured?

All data submitted to us are processed by our internal team and viewed only by the insurer selected by you. We strongly support the

Personal Data Protection Act (PDPA), which dictates that we keep your information private & confidential and prevent them from any misuse in any way whatsoever. You may also see our

Privacy Policy.

-

Will I receive any call from Fincrew ?

We understand that receiving tele-sales call can be annoying so we will not call you to upsell any products. We will only call you if there’s a need to, like example: on claim related matter. However, you may still contact us if you need help on any issue. Our dedicated customers’ service team is always ready to assist you.

-

What are some of the key terms and conditions that i should be aware of?

Importance of Disclosure

You must disclose all material facts that you know or ought to know such as your personal pursuits and medical condition which could affect the risk profile; otherwise your policy may be invalidated.

Cash before cover

Full premium must be paid and received by us before the effective date of the policy. If this condition is not complied with then this insurance policy is automatically null and void

-

Do I need to type in my details again if I'd like to buy again in the

future?

No, you don’t need to. Our system is designed to auto create an account for each success buyer. You can check your mailbox for the login details or

contact us to request for your account details.

-

Help! I made a mistake on my personal info when I was buying insurance.

-

If I have an enquiry on any products or any other questions, who should I

refer to?

-

What do I need to do if there are changes to my contact/personal details?

It is important that you inform us of any changes in your contact and personal details to ensure that all correspondence reach you timely manner.

-

How do I lodge a complaint if I'm unhappy with the product or services?

Please do not hesitate to

contact us with your feedback, and we'll try to resolve the matter.

-

Can I buy this insurance online with a supplementary credit card?

Yes, you can.

-

How can I pay for the policy I buy?

You can pay online through credit card, debit card or e-banking.