Insurance can be a very complex subject to understand. Yet, it would help if you had a good grasp of it, so you know whether to accept the product or service that any insurance company offers. To that end, it is essential to know what to ask an insurance agent when you plan on taking out any policy with them. Whether you want to buy life insurance or get coverage for your car, here is all you need to know to understand how coverage policies work in Malaysia.

-

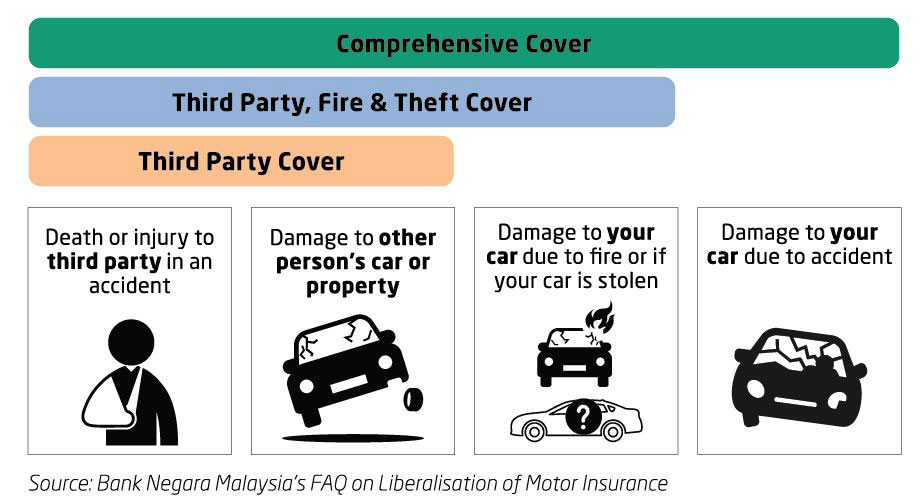

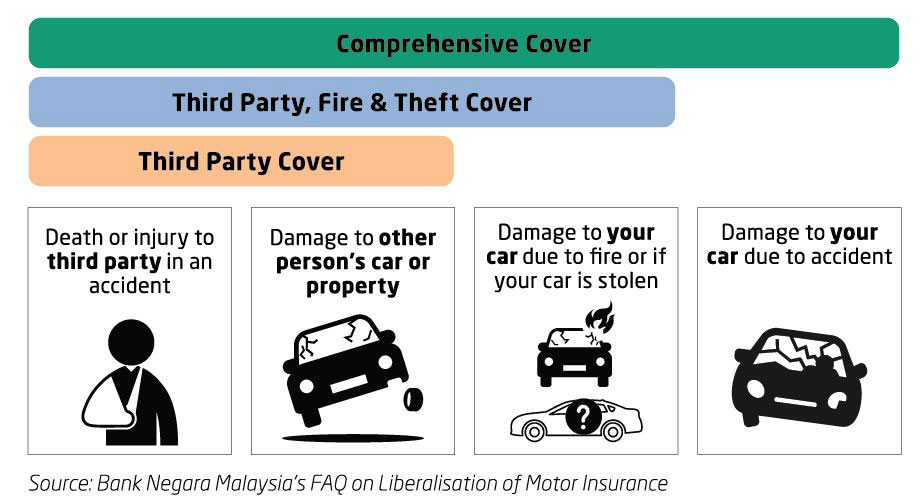

What is comprehensive motor insurance policy?

This policy provides insurance against damage to your own vehicle and/or your liabilities to other parties such as injury or death and damage to other parties’ property because of a motor accident.

-

How will my Auto Insurance premium be calculated?

Insurance premiums will be based on risk characteristics. The greater the potential risk, the higher the premium. The lower the potential risk, the lower the premium

-

What is auto Insurance Liberalisation?

This means the price of motor insurance will no longer be based on Motor Tariff (a set of fixed price list).

-

How do I determine the sum insured for my car?

The sum to be insured should be based on the market value of your car. Market Value represents the value of your car with an allowance for wear and tear and/or depreciation.

-

What is the major exclusions for Comprehensive Auto Insurance?

This policy does not cover certain losses such as:

- Policyholder's death or bodily injury due to a motor accident;

- Policyholder's liability against claims from passengers in your vehicle; and

- Loss, damage or liability arising from an act of nature i.e. flood, storm or landslide.

(Note: This list is non-exhaustive. Please refer to the policy contract for the full list of exclusions under this policy.)

-

What is No Claim Bonus (NCB)?

No claim bonus is a special discount given for every claim-free year.

-

What's an excess?

Most policies include an excess, which is the amount to be paid by the policyholder in the event of a claim. There's both a compulsory excess, imposed by the insurer, and a voluntary excess. The phrase 'total excess' combines these two factors and is the amount you pay in the event of a claim.

-

What is loading?

Loading is an additional amount that is built into the insurance cost. This amount is added to the premium to provide the cover for a ‘risky’ individual. Basically, loading covers the losses that arise from insuring an individual who is prone to a form of risk and the losses for that period are expected to be higher than anticipated.

-

Why is the No Claim Discount (NCD) quoted is different from my record?

The NCD quoted is different if there is a claim lodged or if there is an NCD withdrawal to transfer to another car requested by the insured. Alternatively, you can also check your current NCD rate via Ncd Checker

-

What is Market Value coverage?

Market Value is the amount based on the insurance company estimate of what your car is worth in the open market. In the event that anything happens to your car, you can only claim as much as the current market value/worth of your car model at that point of time. Generally Market Value coverage premium tends to be lower.

-

What is Agreed Value coverage?

Agreed Value is the amount which has been agreed to between you and your insurance company. In the event that anything happens to your car, agreed value coverage can certainly provide the compensation you will receive from the insurance company if your car is written off or stolen. Generally Agreed Market coverage premium tends to be higher .

-

Is there any after sales & claims services offered to customer after insurance purchase?

No after sales services are offered after insurance purchase. You may contact your chosen insurance company for after sales services.

-

Can I purchase this product direct from insurance company?

Yes, to purchase direct from your preferred insurer, you may contact insurer or visit insurer’s website or walk-in to nearest insurer’s branch

-

What is an extended warranty program & why do you need it?

Your compulsory car insurance protects you in case of an accident or theft, but will not pay for car breakdowns. Adding an extended warranty plan gives you additional protection against unexpected breakdowns and the cost and stress that comes with them. With

auto insurance plus

car extended warranty, you truly have total protection.

-

Why choose Fincrew extended warranty?

✓ Credibility – Fincrew partnered with Warranty Smart, Warranty Smart is a pioneer in the car extended warranty industry, first established in Malaysia since 2013 and has expanded its operations in Thailand and Indonesia.

✓ Insured – By a leading insurer, Pacific & Orient Insurance Co.Berhad (P&O).

✓ Expertise – Warranty Smart have the largest network of technical expertise with over 182 panel workshops nationwide.

✓ Convenience – Warranty Smart allow open service concept at any workshop, panel or non-panel

-

What does extended warranty cover?

We have a variety of different plans available. At Fincrew extended warranty, we practice transparency to our users, hence coverage are also listed in our website for each respective plan. You can choose the level of coverage or speak to our knowledgeable sales representatives +6018 228 8606 to help you select the plan that’s right for your vehicle.

For existing members, please refer to your warranty policy for detailed components covered.

-

What kinds of replacement parts will you put on my vehicle during a claim?

Warranty repairs will be made entirely at the discretion of Fincrew / Warranty Smart who reserves the right to either repair/recondition damaged components, or to replace damaged components with used, reconditioned or OEM parts. However, if you intend to request for brand new original parts, you could communicate to our claim adjuster before commencement of the claim job. Such replacement is only possible if you agree to top up the difference between the cost of a brand new part and that of a used/reconditioned/OEM part.

-

What do claim limits on the extended warranty plan mean?

Each type of warranty plan has its own respective claim limits. For example, Gold plan has limit of RM10,000 per claim, with total aggregate claims up to RM50,000. This means RM10,000 is the maximum limit for each claim, and you can have unlimited number of claims throughout your warranty period, as long as it is within covered components & as long as your total claim limit of RM50,000 still has available balance. Repetitive claims are also allowed on the same components.

-

Does Fincrew / Warranty Smart pay for labor charges?

Absolutely. For all covered claims, we will take care both the costs of parts and labor.

-

Which parts are not covered by warranty?

Generally, any part not listed under covered components of each type of warranty plan will not be claimable. All extended warranty policies tend not to include wear & tear items such as filters, spark plugs, fluids, brake pads, tyres etc.

-

Do I need to inspect my vehicle before purchasing?

Yes. We will provide a free inspection service on your vehicle for approval.

• For Klang Valley locations, you can make appointment for our door-to-door mobile inspection.

• For outside Klang Valley locations, you can drive in to any of our authorized panel workshop nearest to you!

-

How do I know if my vehicle is eligible to purchase the extended warranty plan?

Generally, Fincrew extended warranty plans are eligible for vehicles up to 10 years of age from its manufacture year & within 150,000kms odometer reading. If your vehicle is over 10 years from year make, or running more than 150,000kms, we will evaluate your eligibility based on vehicle condition upon our inspection.

-

When does my coverage begin after purchase?

Your warranty commencement date & mileage will be stated on your warranty policy. Unlike other extended warranty companies, we do not apply any cooling period. This means you can claim almost immediately from the warranty start date

-

Is towing provided when breakdown happens?

Owner to utilise own vehicle’s insurance towing.

Towing to AUTHORISED WARRANTY SMART PANELS ONLY for claims.

-

How do I know if my car problem is claimable under warranty?

You can take your car to our nearest authorized panel for checking/diagnose and such service is free! The panel will be in contact with our claims department to determine if the fault is a covered item under your warranty plan.

-

How do I file for a claim?

At Fincrew, we strive for a no-hassle claim process. Simply call our claims department @ ++6018 228 8606. A personalized claim advisor will walk you through the process. Already at our authorized panel? The panel will determine the cause of failure & as long as it is a covered component, it will be taken care for you!

-

Do I need to pay upfront for claim?

No. You do not need to pay for an approved claim. No waiting for reimbursements as we get you back on the road fast! Once the repair is completed, we will pay the panel workshop directly. You will only be responsible for any non-covered charges (if any).

-

How do I check the status of my claim?

You can call/whatsapp our claims department directly @ +6018 228 8606 for instant repair status update!

-

What happens when a part is not covered?

If the problem is not within your warranty plan coverage, we are still here to help you. We will act as your liaison to the repair process, making recommendations, and ensure you aren’t getting taken advantage of. We aren’t just selling you warranty, we are fully backing you up!

-

If I file for a claim, will my premium increase the next time when I renew my warranty?

Absolutely No. No matter how many claims you file, your premium will not increase. Likewise, no-claim-discount is also not available for all extended warranty plans.

-

Where can I take my car for service?

Fincrew / Warranty Smart adopts “Open Service” concept for your convenience! You are allowed to maintain all routine services at any of your own preferred workshop, regardless it is our panel or non-panel. Only checking of faults & claims on covered items must be performed at our authorized panel workshops.

-

What responsibilities do I have to keep my warranty active?

• You need to maintain your routine services timely and keep proper records for all the maintenance in your warranty service booklet (workshop stamps).

• Ensure safekeeping of your warranty service booklet. If your booklet is lost, please report to us immediately for a replacement booklet at a charge of RM100. The booklet is compulsory in the event of a claim.

• Do not misuse, neglect or modify your vehicle during your warranty period.

-

Can I transfer my warranty to new owner if I sell my car?

Definitely! Warranty stays with the vehicle regardless of change in ownership. This also mean that your car warranty can add value to the selling of your used car.

-

Can I cancel my warranty?

Once your warranty plan is activated, it is non-refundable and non-transferable to another vehicle.

-

Why do I need travel insurance?

It is important to have travel insurance while you are travelling in case of accident, illness or loss of personal belongings. You may compare and get the comprehensive coverage from different insurance companies at Fincrew.

-

What does travel insurance cover?

Travel insurance provide accidental cover, illness or loss of personal belongings etc. Some insurance company provide additional benefits such as trip cancellation, pandemic cover or sports equipment.

-

What is a pre-existing medical condition?

A medical condition that started before a person’s insurance went into effect.

-

When should I buy travel insurance?

You should buy your travel insurance before your trip start and it is advisable to start 1 day or earlier before your trip.

-

Does travel insurance cover natural disasters?

Most of the travel insurance cover natural disasters and subject to the terms of the policy. It is important to compare your travel insurance at Fincrew.

-

How long does travel insurance Last?

Some of the insurance company cover up to 190 days for single trip and 90 days for annual trip cover. It is important to consult Fincrew Customer Service or refer to Product Brochure or Policy Wording from the respective insurance companies.

-

What is the use of trip cancellation insurance?

This benefit compensates you for irrecoverable travel and accommodation expenses as a result of trip cancellation due to serious injury or illness.

-

Can I cancel travel insurance if I cancel my trip?

You may terminate the policy at any time by giving a written notice to the company within fourteen (14) days or contact our Customer Service Centre

here. Such termination shall become effective on the date the notice is received by the Company or the date specified in the notice, whichever is earlier. No premium will be refunded upon cancellation of cover.

-

What is Personal Accident Insurance?

It is a type of insurance that financially protects you or your loved ones if you get into an accident or suffer a disability. Also commonly referred to as supplemental coverage, please remember that this policy isn’t tied to a health insurance plan. So, your insurance company is obligated to pay you directly if you get involved in an accident or sustain a temporary or permanent disability covered by your policy.

-

Why Should You Buy Personal Accident Insurance?

In most cases, an accident occurs without forewarning or prior notification. Because of this, you can’t afford to leave yourself unguarded. Some reasons you’re better served to have this coverage is that it;

- It takes care of you if you have a temporary or permanent disability.

- It covers all your major medical expenses as a result of the accident.

- Compensates your family if you die as a result of the accident.

- Caters to logistics like yours and your family’s transportation while you’re indisposed due to the accident.

-

Why Should You Compare Personal Accident Insurance?

Using a reliable tool like the FinCrew personal accident insurance comparison tool is essential. The most important is that each insurer puts their spin on this coverage. And, considering your unique circumstances, what one insurance company offers you in this area may be much more appealing than the offering of another. So, with a good comparison tool, it becomes easier to find the perfect Personal Accident insurance policy for you efficiently.

-

Who Is Eligible To Purchase Personal Accident Insurance?

All Malaysians, Malaysian permanent residents, work permit holders, pass holders or otherwise legally employed in Malaysia. Person age is depended on the respective insurance’s plan.

-

Will This Policy Still Pay If I Have Other Similar Insurance Policies?

Yes, the respective insurance company will pay in addition to any other policies you may have except for medical expenses which have been reimbursed by other policies.

-

How Does Double Indemnity Work?

Double Indemnity means benefit payable will be doubled if the Insured Person suffers death or permanent disability due to an accident while travelling as a fare-paying passenger on a public mode of transportation.

-

How Will I Be Entitled For Renewal Bonus?

As long as you renew your policy and there is no claim under Accidental Death or Permanent Disablement in the preceding year, a % Renewal Bonus of the Principal Sum Insured will be rewarded. Only claims under Accidental Death or Permanent Disablement will affect your Renewal Bonus.

-

Is Medical Expenses Benefit Payable Per Disability?

Yes, the respective pay up to the sum insured for medical expenses for each accident and the limit is as per the respective insurance company’s plan.

-

What Does a Personal Accident Insurance Cover?

Depending on the extent of your coverage, this policy can insure you for both minor and major accidents. In addition to financially protecting you in the event of fatality, you’re also guaranteed partial or total disability. The fine print of the specific Personal Accident insurance you get will contain more specific details on the protection you enjoy with this policy.

-

What Is Excluded In Personal Accident Policy?

Some of the things excluded under a standard Personal Accident insurance policy include;

- Death or injury due to suicide.

- Sustaining injury while under the influence of drugs or alcohol.

- Injury sustained due to acts of war, civil war, and other incidents of this nature.

- Death or injury while engaging in physical activity like bungee jumping, ballooning, etc.

Your insurance policy will contain a complete list of all exclusions, so read it carefully.

-

Can a Personal Accident Cover Be Granted To a Proposer Where War And War-Like Situations Prevail?

In most cases, many insurers will decline such a proposal. And the few that will take it on may opt to do so only at a considerably high premium.

-

What is Permanent Total Disablement, Permanent Partial Disablement & Temporary Disablement?

Permanent Total Disablement or PTD refers to a case where the disability sustained is absolute because of an accident. It is irrecoverable. Permanent Partial Disablement is similar to PTD, except that the disability sustained is not complete or is partial. Temporary disablement refers to instances where the disablement only lasts a specific period. The individual will eventually recover full use of their body.

-

How Do You Classify Occupations?

Occupations are classified into 3 classes as follows:

Occupation Class 1

Persons engaged in professional administrative, managerial, clerical and non-manual occupations

Occupation Class 2

Persons engaged in work of supervisory nature but not involved in manual labour

Occupation Class 3

Persons engaged either occasionally or generally in manual work which involves the use at tools or machinery

-

Why Consider Getting Auto Service Finance in Malaysia?

The auto service financing program provides a readily accessible personal loan for car repairs you can leverage when in a bind. You can return the sum used in a small monthly payment form. The reasonable loan terms afforded to ensure that you have a backup for funds if you ever have trouble with your car.

-

How is This Program Shariah-Compliant?

As you won’t have to deal with interest charges, mull over interest rates, or do anything considered Haram, this financing option is one fit for a true Muslim believer to consider.

-

How Fast Can I Get Approval For This Financing Option?

You can get approval for these auto repair loans in under a minute. However, it can sometimes take as long as 15 minutes.

-

What Are the Requirements For Getting This Equity Loan?

You need to be between 18 and 65 years of age. Also, you need a valid bank account. However, you can secure this funding without a credit card.

-

Can I Get My Auto Repairs Once My Application Has Been Approved?

Yes, you can. But keep in mind that you have access to a specific loan amount. So, you need to make sure you know how much credit you can get before you make any appointments with a registered workshop.

-

What’s the Profit Rate of This Auto Repair Finance Loan?

This value depends on the condition of your Credit Score, but it’s usually between 0.8 and 1.5% monthly.

-

What’s the Loan Amount Range For This Financing option?

With this lending feature, you can get a minimum of RM 100 and a maximum of RM 5 000.

-

What Loan Tenure Can I Expect?

This variable is usually determined at the discretion of the Financier.

-

Must the Financier Physically Sign Off on the Loan Terms?

No, this isn’t necessary.

As provisions have been made for digital signing, the transaction can be completed from any preferred location.

-

Do These Auto Repair Loans Require Collateral or a Guarantor?

No, they don’t.

-

Can I Fully Settle the Loan Before Maturity?

Yes, you can.

However, you must first give a 1-week written notice so all the necessary documents to legalize that action can be prepared. After you’ve done this and eventually settled the financing, you’ll receive a rebate for the deferred financing.

-

Is Direct Lending Legit?

Yes, it is.

As the Financier of this facility, Direct Lending Sdn Bhd has all the necessary licensing and certification to carry out such activities in Malaysia. In addition to being registered under the Ministry of Housing and Local Government, it’s also duly recognized by Cradle Fund Sdn Bhd and the Malaysian Global Innovation & Creativity Centre (MaGIC).

-

What’s the Partnership Between FinCrew and Direct Lending?

FinCrew is currently the official partner in sales to Direct Lending and is actively involved in helping make the auto service finance facility more readily available to Malaysians.

See more information here.

-

Can I Write a Will Without Any Witnesses? Will it be Valid?

For your will to be valid, there are specific steps that you must follow. That being said, you can write a valid Will in the absence of any witnesses. However, your will is only considered valid and undisputed if you sign it in front of witnesses. So, while most wills are prepared without anyone present, you need it witnessed to ensure it’s completely valid and honored by the law in your absence. When choosing witnesses, keep in mind that any beneficiary of your will won’t be recognized as a witness.

-

Can You Write a Will At Any Age?

The law requires you to be at least 18 years of age to prepare a valid Will. Provided you’re at or above 18, the law willfully acknowledges will and the final testament you put together.

-

How Important Is a Will? Should You Write a Will?

Putting together a will is critical because it secures your estate upon your passing and takes care of the ones you leave behind. With a Will, everyone knows what you want, and any incidents of misunderstanding will be minimal. You should write a Will because it puts you in control and helps you attend to all your affairs in detail.

-

What Is a Good Age To Write One’s will?

There’s no better time than the present! Provided you’re above 18, and of sound mind, it never hurts to have your will prepared. You can then update it as events transpire.

-

Do I Require An Attorney To Execute a Will?

Strictly speaking, the law doesn’t require that an attorney must be the executor of your will. Virtually anyone can execute your choice, provided you consider them competent enough to handle the task. Having established this, it bears mentioning that it’s often recommended that you have an attorney execute your will as they understand the legal terrain better and will have an easier time of the affair.

-

What Happens If a Will Is Signed But Not Witnessed?

If your will isn’t witnessed or appropriately witnessed, it’ll automatically be deemed invalid by the law.

-

Under What Situations Can a Will Be Revoked?

There are several things that a testator (you) can do that may lead to the revocation of your will. For example, the regular operation of the law will revoke a choice if prepared before you had a second marriage. Also, destroying the will yourself or directing someone to do the same on your behalf can lead to the legal document being revoked.

-

Can One Person Write Two Wills at the Same Time?

Yes and no. A person can have two wills in effect at the same time if the wills govern two different estates. However, one person can’t have two wills controlling one estate simultaneously.

-

Is it Legal to Apply For the Loan Through FinCrew? Is That Ah Long?

Yes, it is.

As FinCrew is an official partner of Vanta and Boost Credit, you won't be breaking any rules if you apply for a small business loan with us because both partners are big names operating entirely within the confines of the law.

-

How Does an SME Loan Work?

A small and medium-sized enterprise loan is a type of funding designed to cater to SMEs that meet specific criteria. As such, it typically doesn't require collateral. You can easily access such services if your business meets the requirements and can find an excellent Financier.

-

Why Are SME Loans a Better Alternative to an Investment?

Because SME loans help you achieve a lot more, for example, they help you expand faster, get a better position to capitalize on various emerging economies, and even enhance your creditworthiness.

-

What is the Purpose of an SME Loan?

The main purpose of these loans is to support the financial needs of a small or medium-sized establishment.

-

What Credit History is a Factor for an SME Business Loan?

The most crucial credit history here is your Credit Score. However, how much this variable matters will vary from one financial institution to another.

-

What is the Tenure of an SME Business Loan Repayment?

Again, this depends on the financial institution; however, the loan tenure is usually from 12 months to 7 years.

-

How Much SME Business Loan Do I Qualify?

There's no fixed value for this as several variables influence the size of the loan amount you can get. It includes factors like the size of your annual income, your Credit Score, and type of business. For instance, if you own an Sdn Bhd company, you can choose either Boost Credits or Vanta Capital. But if your company is sole proprietorship, you can opt for Boost Credits, which have a lower entry-point for the loan.

For Sole proprietors, enterprises, and any kind of company:

- Boost Credits

- Minimum 1k to maximum 100k of loan

- Full digital AI approval process within 3 minutes

- For larger companies (Only Sdn Bhd)

- Vanta Capital

- Minimum 200k to maximum 10 millions of loan

-

Why Are Loans Important to Businesses?

Because it gives businesses the resources they need to better themselves, especially in developing countries.

-

Why is it Difficult For Small Businesses to Get Loans?

It is often due to several reasons, including insufficient credit lines, limited cash flow, and too many work applications.

-

How Long Should it Take to Process an SME Business Loan?

It depends on the financial institution. For example, FinCrew can get you the resources you need in 24 to 48 hours, and it usually takes much longer for many other financial institutions in Malaysia. Take the first steps towards securing that business today!

-

What Is a Koperasi Loan?

A koperasi loan (or a Cooperative loan) is a type of credit service from Cooperatives or Foundations (Yayasan) that’s available only to civil servants working in the government, local municipal councils, as well as selected government-linked bodies. Credit cooperatives are registered with the Cooperative Commission of Malaysia (SKM) and regulated under the Cooperatives Act of 1993.

-

Who Runs Koperasi Loans?

Only civil servants and selected staff members who work for federal or state governments, municipal workers, statutory bodies, government-linked agencies and others. Each cooperative loan will have a list of employers who are eligible to apply; for example this includes members of organisations such as PKNS, SYABAS, TNB (Tenaga Nasional Berhad), public universities, and many more.

Koperasi loan providers may also require that civil servants be employed for at least six months at said government body. You can apply for a koperasi loan if you are 21 (some providers have a lower minimum age of 18), up to 58 years of age. A monthly wage of RM1,500 is usually set as the minimum required to be eligible to apply for a koperasi loan. Private sector employees and those who run their own businesses are not entitled to apply for koperasi loans.

-

What Are The Credit Criteria To Fulfill When Applying For a Koperasi Loan?

It is less strict compared to conventional bank loans. Cooperative loans tend to set a slightly lower credit approval criteria as loan repayments are directly deducted from the borrower’s salary by Biro Perkhidmatan ANGKASA (via SPGA – Sistem Potongan Gaji BPA) or the Accountant General’s Department.

Koperasi loans are attractive to civil servants because those with a less-than-stellar CTOS records, blacklisted in CCRIS (with a Special Attention Account) and even registered with AKPK are still eligible to borrow. Furthermore, loan applicants with high payment commitments or debt service ratio (DSR) will also be considered by koperasi loan providers, unlike conventional loans.

-

How Does The Repayment Work?

Monthly repayments are conducted via an automatic salary deduction scheme by the National Cooperative Movement of Malaysia, or better known as Biro ANGKASA as mentioned previously. Likewise, some koperasi loans also accept deductions via the Accountant General’s (AG) Department. The Public Services Department imposed a rule that loan instalments plus other deductions cannot exceed a set limit of 60%; this was designed such that the borrower’s take-home pay is at least 40% of his or her gross salary to ensure that a decent standard of living is still possible.

-

What Are The Loan Tenures Available?

Koperasi loan tenures are up to a maximum of 10 years, as stipulated by the government. Conventional bank loans, on the other hand, usually only reach seven years.

-

How High Are The Interest Rates And The Payouts Available?

Interest rates (or profit rates, if they are Islamic-based) are also lower than most banks; expect as low as 3.88% per annum from selected koperasi loan providers. You will also need to take into account the potential loan payout available to you. One can borrow up to RM250,000 or the maximum installment amount that can be deducted from the borrower’s pay. However, it is important to note that the loan sum disbursement is rarely 100%, and you can expect anything between 70% to 98%. This is dependent on the koperasi loan provider chosen. Therefore it’s important to first work out how much the monthly repayment will be before signing up for the loan.

-

What Are The Documents Requested?

- Photocopy of NRIC, verified by employer

- Latest three months’ pay slip

- Verified letterhead from the employer

- Bank statements

- Copy of a utility bill (Tenaga, ASTRO, etc)

- Photocopy of Bank savings account book (could vary depending on the underwriter of the loan)

Different providers would request for a combination of documents for your application, but it’s best to prepare these in advance. Keep in mind that multiple copies of these documents are often requested for, so remember to keep additional copies at hand when forwarding your application.

-

What Can I Use The Koperasi Loan For?

Weddings, unexpected bills, vacation, renovation, emergency situations, almost anything. But of course, Finder expects you to be a savvy spender – a wise one always sets out to plan and manage his or her finances for the future.

-

How Else Is a Cooperative Loan Different From Your Regular Commercial Bank Loan?

The majority of cooperative loans are Islamic-based and therefore Shariah-compliant. Being grounded on Islamic banking and finance principles such as Tawarruq and Murabahah means that the sale and purchase of commodities is payable by instalments or deferred payments. Many koperasi loans also come with compulsory takaful insurance protection to ensure that any outstanding amounts in the circumstances of death or total permanent disability can be accounted for.

-

What is the relationship between Fincrew and the insurance company?

Fincrew is a platform for user to research, compare and purchase insurance. We work with our vendors which represent multiple insurance companies to provide the most up-to-date of insurance products in Malaysia. We are not a subsidiary or affiliated company with any insurance company in Malaysia.

-

Is Fincrew a legal business entity in Malaysia?

Yes, Fincrew is registered with SSM and owned by Fincrew Sdn Bhd 202101032014 (1432314-W) and is governed by the laws of Malaysia in our business operations.

-

How do I know that it's safe to buy insurance online? Will my personal

info be secured?

All data submitted to us are processed by our internal team and viewed only by the insurer selected by you. We strongly support the

Personal Data Protection Act (PDPA), which dictates that we keep your information private & confidential and prevent them from any misuse in any way whatsoever. You may also see our

Privacy Policy.

-

Will I receive any call from Fincrew ?

We understand that receiving tele-sales call can be annoying so we will not call you to upsell any products. We will only call you if there’s a need to, like example: on claim related matter. However, you may still contact us if you need help on any issue. Our dedicated customers’ service team is always ready to assist you.

-

What are some of the key terms and conditions that i should be aware of?

Importance of Disclosure

You must disclose all material facts that you know or ought to know such as your personal pursuits and medical condition which could affect the risk profile; otherwise your policy may be invalidated.

Cash before cover

Full premium must be paid and received by us before the effective date of the policy. If this condition is not complied with then this insurance policy is automatically null and void

-

Do I need to type in my details again if I'd like to buy again in the

future?

No, you don’t need to. Our system is designed to auto create an account for each success buyer. You can check your mailbox for the login details or

contact us to request for your account details.

-

Help! I made a mistake on my personal info when I was buying insurance.

-

If I have an enquiry on any products or any other questions, who should I

refer to?

-

What do I need to do if there are changes to my contact/personal details?

It is important that you inform us of any changes in your contact and personal details to ensure that all correspondence reach you timely manner.

-

How do I lodge a complaint if I'm unhappy with the product or services?

Please do not hesitate to

contact us with your feedback, and we'll try to resolve the matter.

-

Can I buy this insurance online with a supplementary credit card?

Yes, you can.

-

How can I pay for the policy I buy?

You can pay online through credit card, debit card or e-banking.