-

What is gadget insurance?

It is the type of policy that a person gets to financially protect items like mobile phones, laptops, camera equipment, high-tech GPS devices, tablets, and other devices. Getting a Gadget Insurance means that most of these devices are very expensive and not easy to replace. With the protection that this type of policy affords you, it’ll be considerably easier to replace or repair them, should the need ever arise.

-

What Is Covered Under The Policy?

Our standard Gadget Insurance policy will protect you from the financial implications of having the insured item;

- Stolen

- Accidentally damaged

- Exposure to liquid damage

- Sustaining a cracked screen

- Developing a mechanical problem

Beyond this, depending on the exact nature of your policy, you can get things like unlimited claims so you can request compensation repeatedly. Also, you could get access to an exceptional customer service and support team that will hasten the process of fixing or getting you a new gadget.

-

What Are The Major Exclusions Under This Policy?

This policy does not cover loss destruction or damage:

Occasioned by or happening through.

a) Wear and tear, depreciation, gradual deterioration, rust, mildew, moth, vermin or any process of cleaning, dyeing, repairing, restoring or renovating

b) Mechanical or electrical breakdown or derangement.

c) War, invasion, acts of foreign enemies, hostilities or warlike operations (whether war be declared or not) or civil war.

d) Mutiny, strike riot and civil commotion, military or popular rising, insurrection, rebellion, revolution, military or usurped power, martial law or state of siege or any of the events or causes which determined the proclamation or maintenance of martial law or state of siege.

e) Confiscation or nationalization or requisition or destruction of or damage to property by or under the order of any Government or Public or Local Authority.

g) Unattended vehicle

Note: This list is non-exhaustive. Please refer to the sample policy contract for the full list of exclusions under this policy

-

Am I Covered Outside Of Malaysia?

Yes and no. When offered in its purest form, most insurance companies will typically not cover you for the financial costs if any happens to your gadgets outside the country. However, we automatically include a “Worldwide Coverage” in our policy. It ensures you can always file a claim with us if anything happens to the gadget, no matter where you are.

-

What Is The Best Way To Insure a Laptop?

One of the best ways is to take your time to determine what kind of policy you want to get for it in the first place.

-

What Products Does FinCrew Gadget Insurance Cover?

You can always trust us to protect your precious gadgets. Some of the devices we specialize in offering coverage include;

• Importance of disclosure

• Tablets

• Laptops

• Camera equipment

• Smartphones

• Any electrical appliance

-

What Are Some Of The Key Terms And Conditions That I Should Be Aware Of?

• Importance of disclosure

Pursuant to Paragraph 4(1) of Schedule 9 of the Financial Services Act 2013, if you are applying for this Insurance for purposes related to your trade, business or profession, you have a duty to disclose any matter that you know to be relevant to our decision in accepting the risks and determining the rates and terms to be applied and any matter a reasonable person in the circumstances could be expected to know to be relevant, otherwise it may result in avoidance of contract, claim denied or reduced, terms changed or varied, or contract terminated. This duty of disclosure for Non-Consumer Insurance Contract shall continue until the time the contract is entered into, varied or renewed. You also have a duty to tell us immediately if at any time after your contract of insurance has been entered into, varied or renewed with us, any of the information given is inaccurate or has changed.

• You must take all ordinary and reasonable precaution for the safety of the property insured.

• If your property amount insured is less than the actual value at the time of loss (i.e. under insurance), you are deemed to be self-insurance the difference.

• You must inform your insurance company or us in writing on any material changes during the policy period so that the necessary amendments are endorsed to your policy.

-

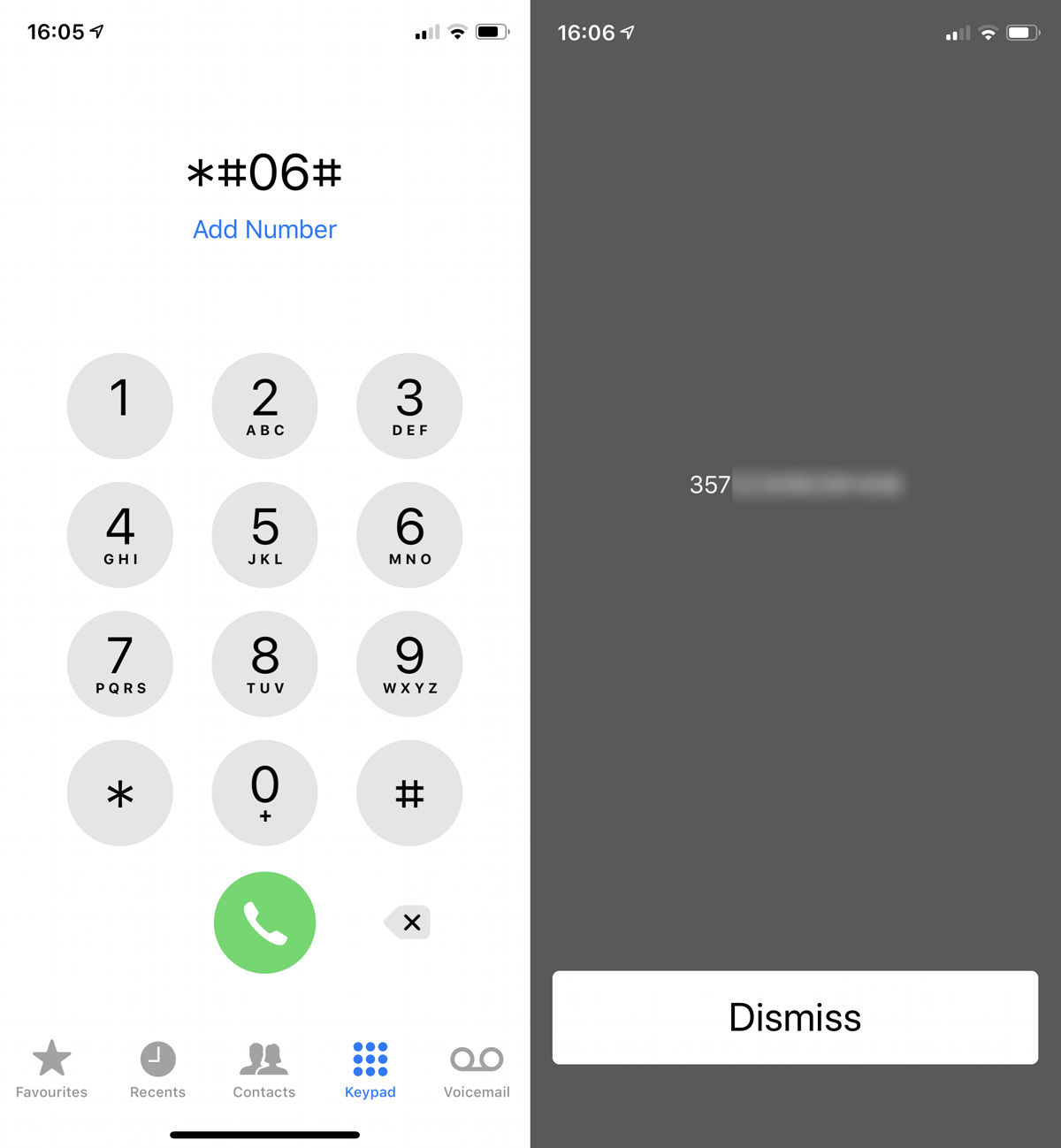

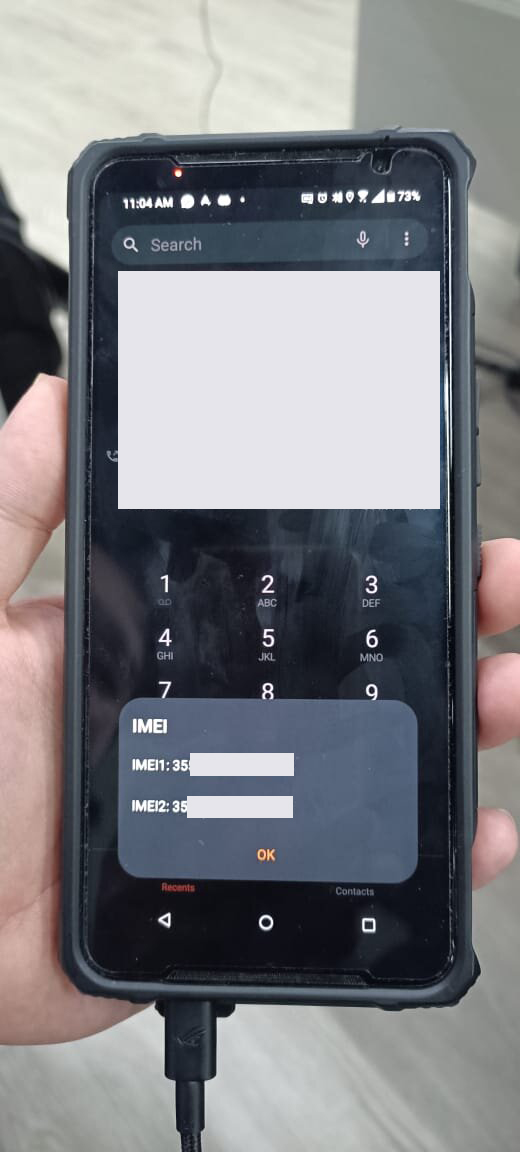

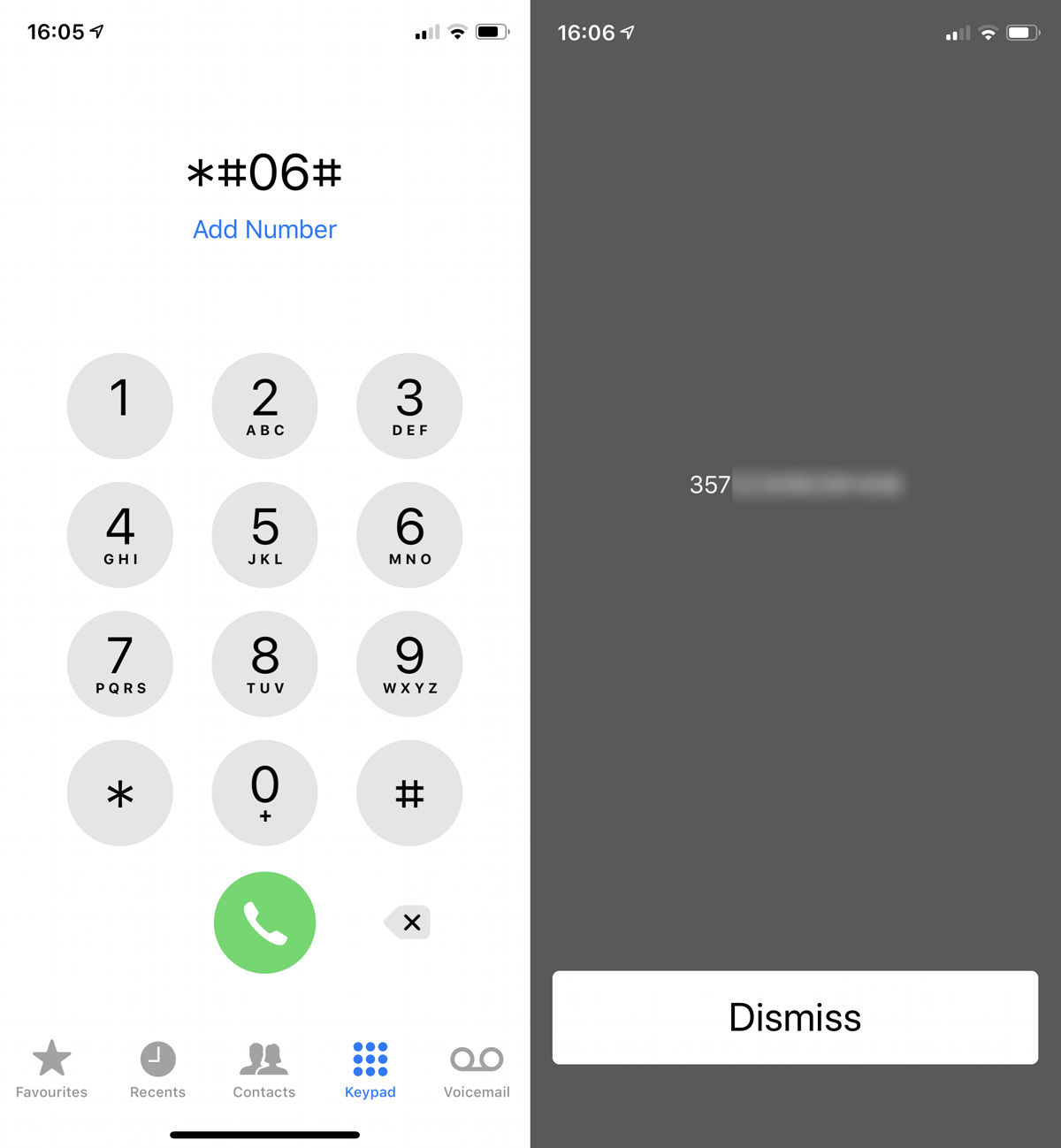

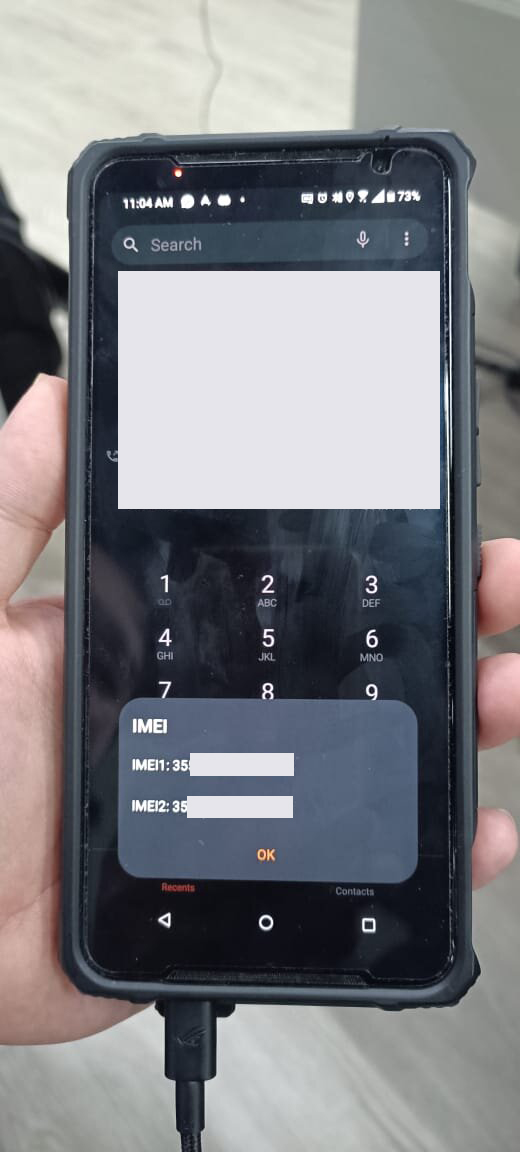

What Should I Need To Do When Buying Gadget Insurance?

You must ensure that your gadget is insured at the appropriate amount and provide with the correct series number of the item insured. You should read and understand the insurance policy and discuss with our live chat team or contact us directly for more information.

-

Can I Cancel My Insurance?

Yes, you can. Once you have duly notified us of your decision, you’ll receive a refund of your premium minus the premium based on the insurer’s short period rates.